Comprehensive Insurance Vs Collision

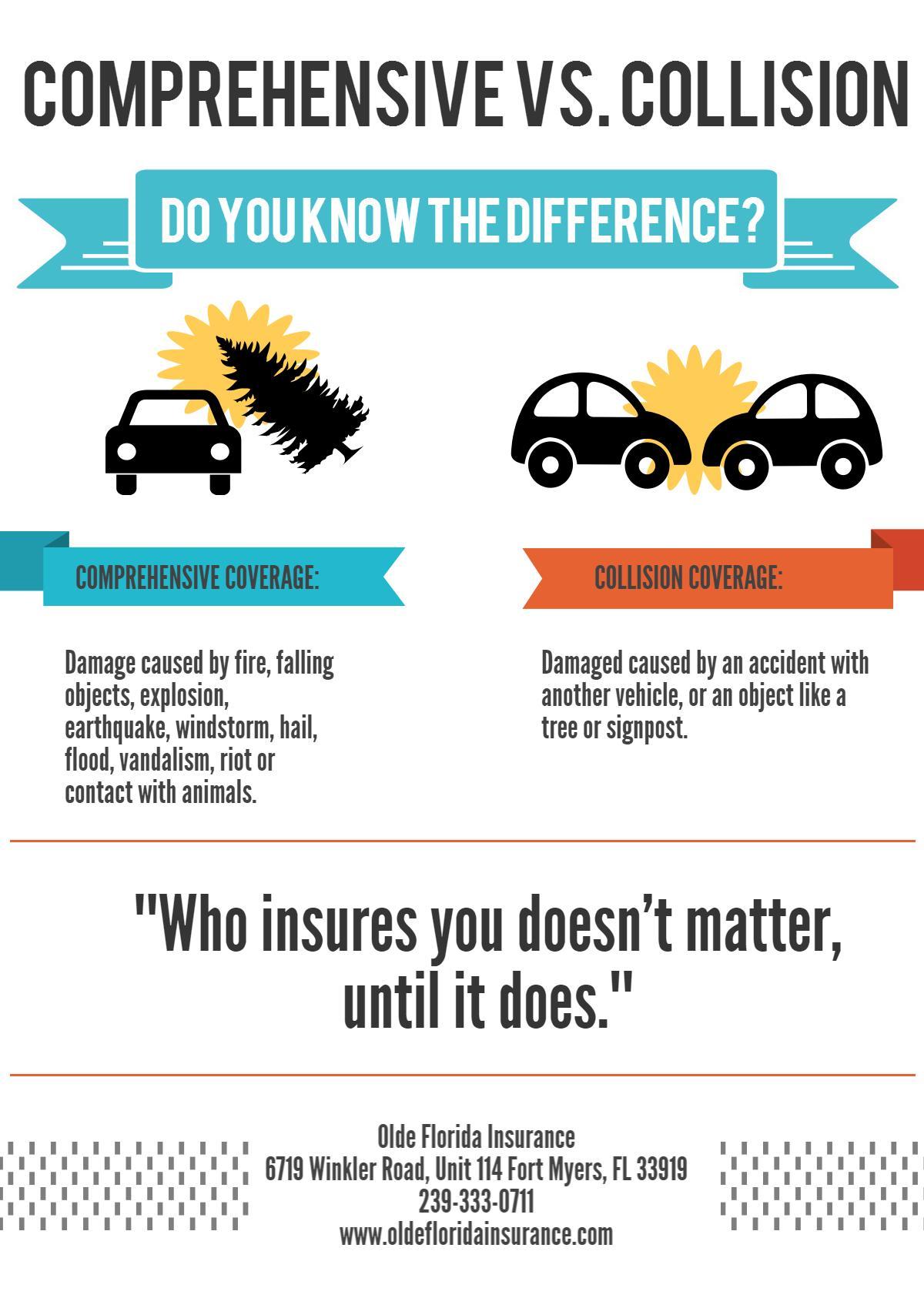

Comprehensive insurance is a coverage that helps pay to replace or repair your vehicle if its stolen or damaged in an incident thats not a collision.

Comprehensive insurance vs collision. Essentially you are protecting yourself against a wider range of risks. In 2015 about 6 of drivers with collision insurance filed a claim that was on average worth 3350 while 273 filed a comprehensive claim that was worth 1671. This can cause confusion. Comprehensive insurance is commonly confused with collision.

Comprehensive insurance covers damage to the insured vehicle that occurs as a result of anything other than collision. They both insure your car but cover different events. Getting just comprehensive insurance. Both play an important role in keeping your vehicle in tip top shape.

In some cases comprehensive insurance covers the situations that collision insurance does not which is why bundling the two together can work in your favor. Without them you wont be covered for certain types of damage to your vehicle or for theft. Comprehensive and collision insurance can be important parts of an auto insurance policy. Both are optional under state laws.

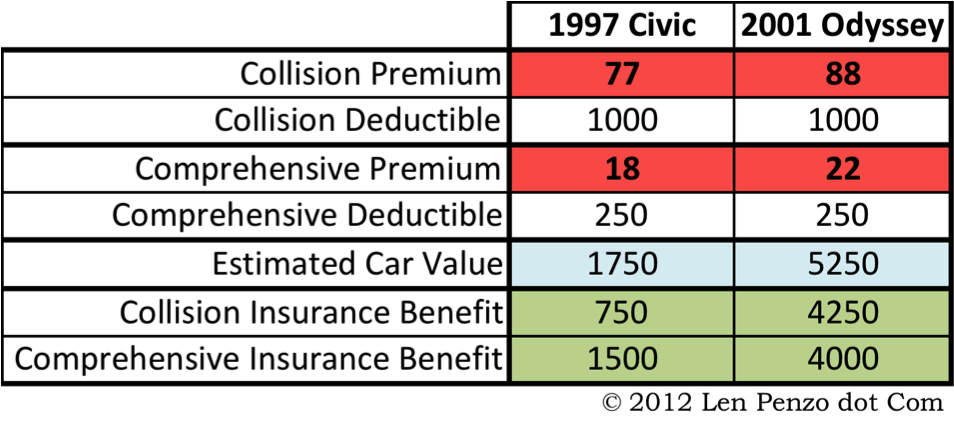

Most insurance policies include hitting a deer under comprehensive insurance rather than collision. Collision generally costs a little more than comprehensive insurance. However if you have purchased a new car with a car loan or are leasing one your lien holder may require that you carry these coverages as part of the terms of your agreement with them. Iin short no you are not required by law to carry comprehensive insurance or collision insurance.

Are comprehensive and collision coverage required by law. This can be a result of mother nature fire or vandalism. Collision is colliding with something else other than animals. Some insurance providers will require the purchase of comprehensive coverage before you can buy collision coverage but not vice versa.

What is the cost difference between comprehensive vs collision. Comprehensive car insurance pays for damage to your vehicle caused by covered events such as theft vandalism or hail which are not collision related. Comprehensive sometimes called other than collision coverage typically covers damage from fire vandalism or falling objects like a tree or hail. Comprehensive and collision are the two types of physical damage coverage available on car insurance policies.

What is comprehensive insurance. Think of it like this. Collision covers car accidents and comprehensive covers events out of your control. Adding either comprehensive or collision insurance to your policy will increase your premium compared with a liability only policy.

/damaged-bumpers-from-car-accident-1042683874-5c243fd646e0fb00017fe8e9.jpg)

.jpg)