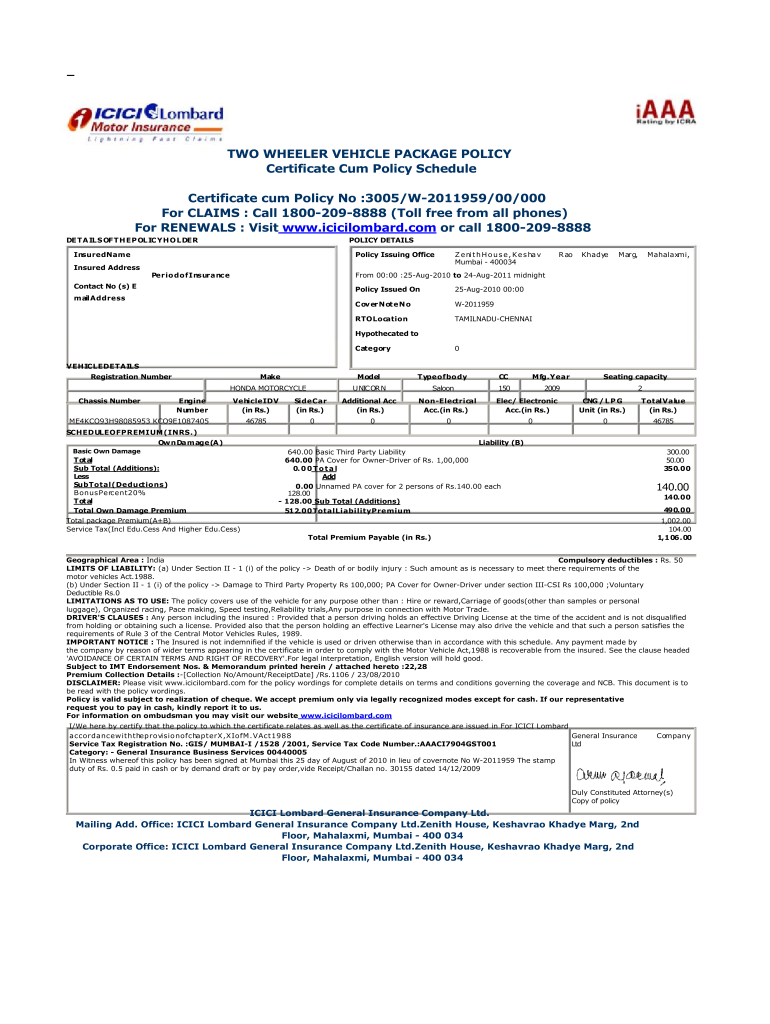

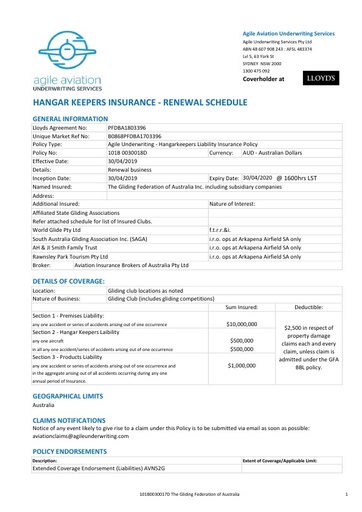

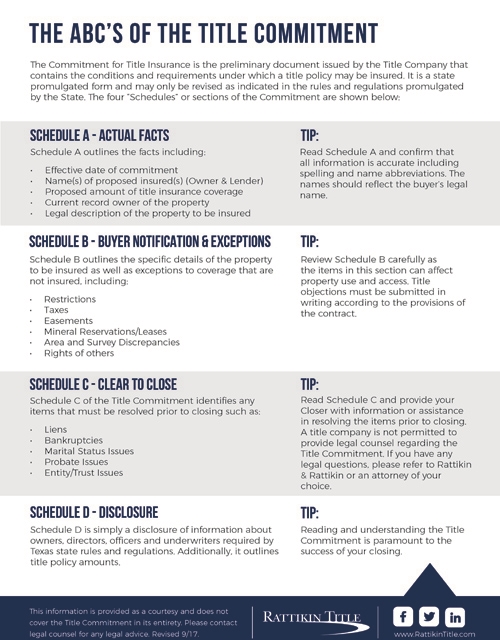

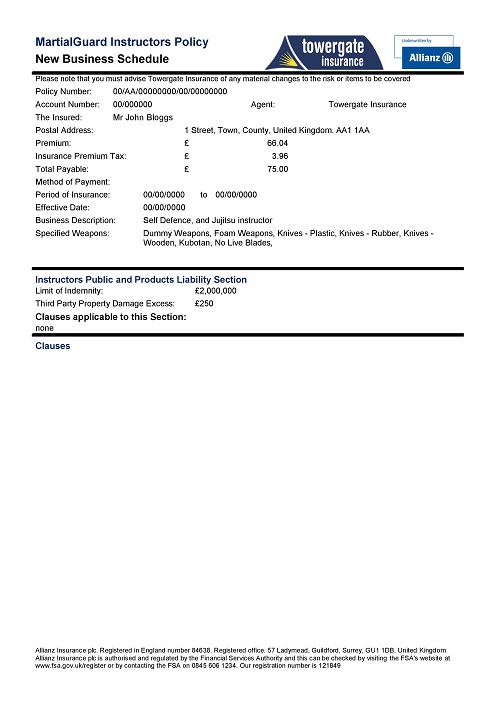

Insurance Policy Schedule

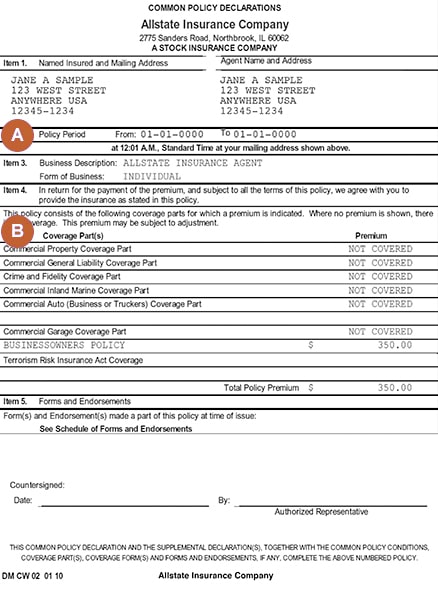

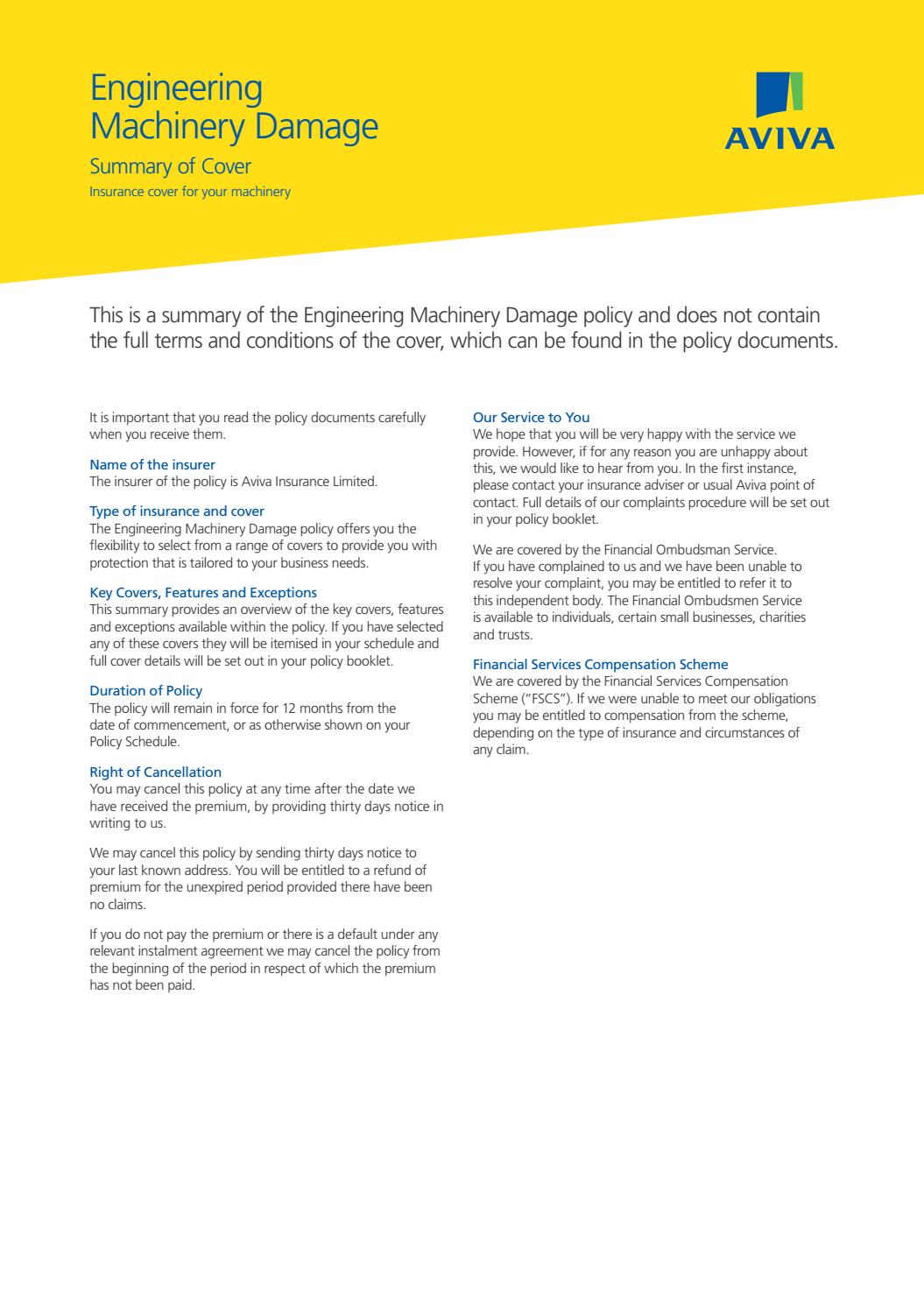

A schedule of insurance is a detailed list of property or other items that will be covered by an insurance policy.

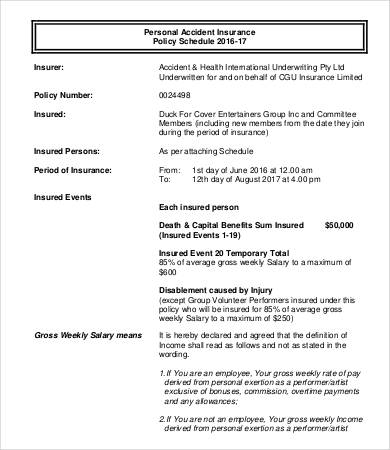

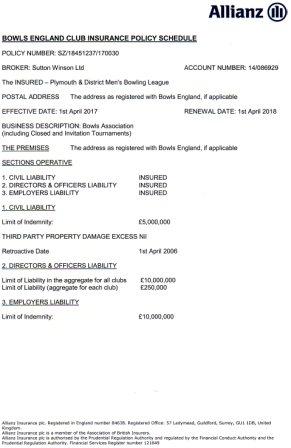

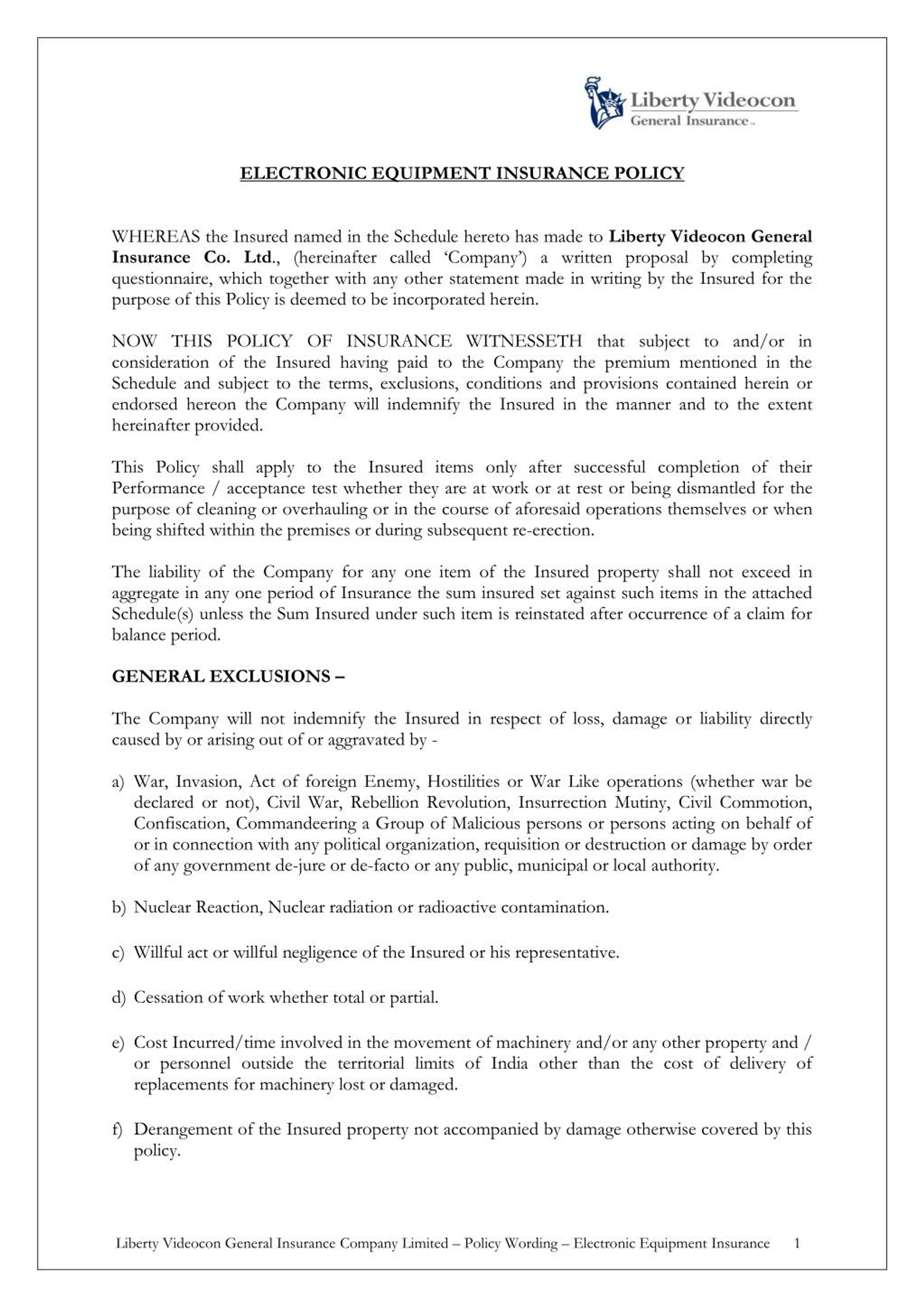

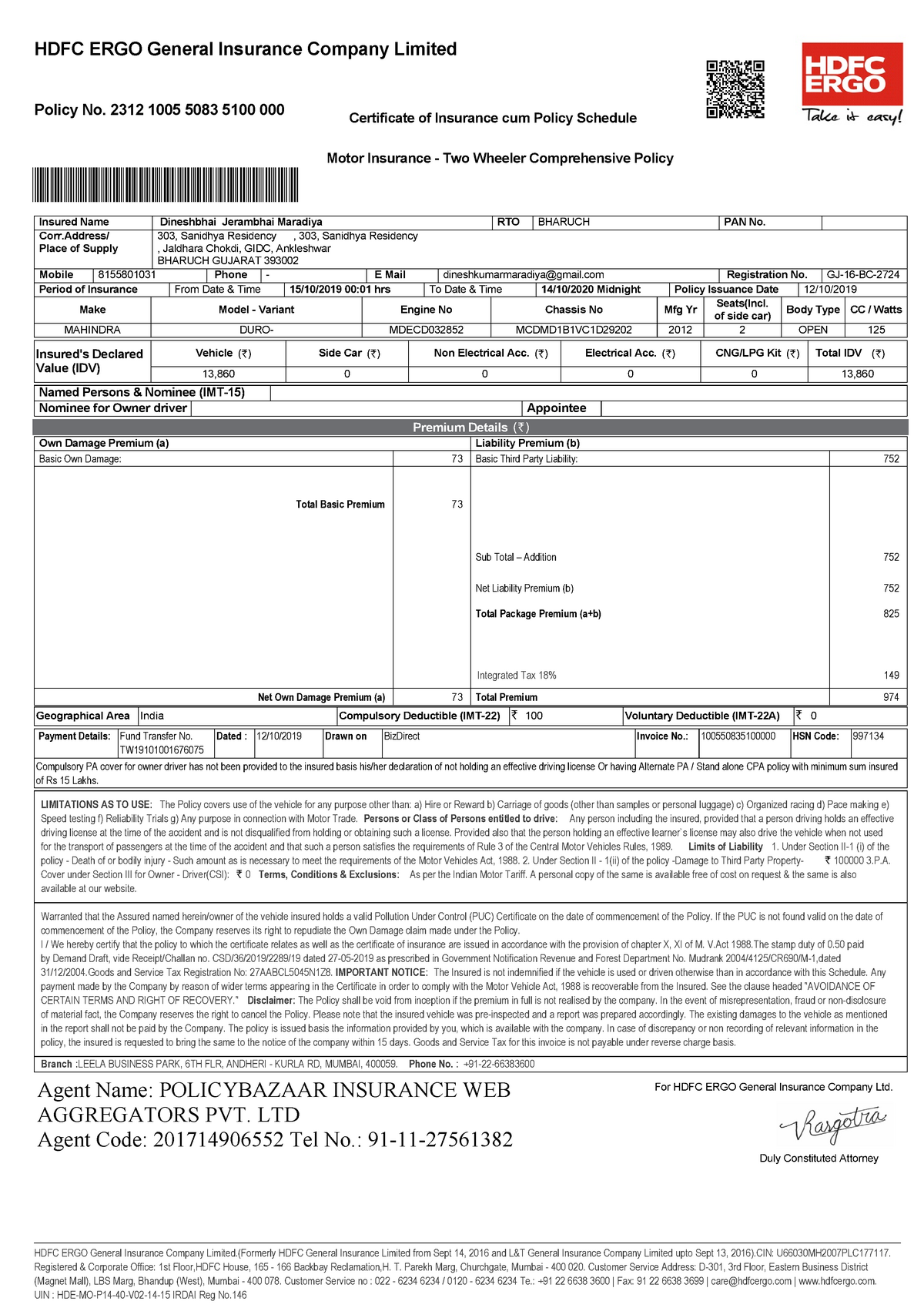

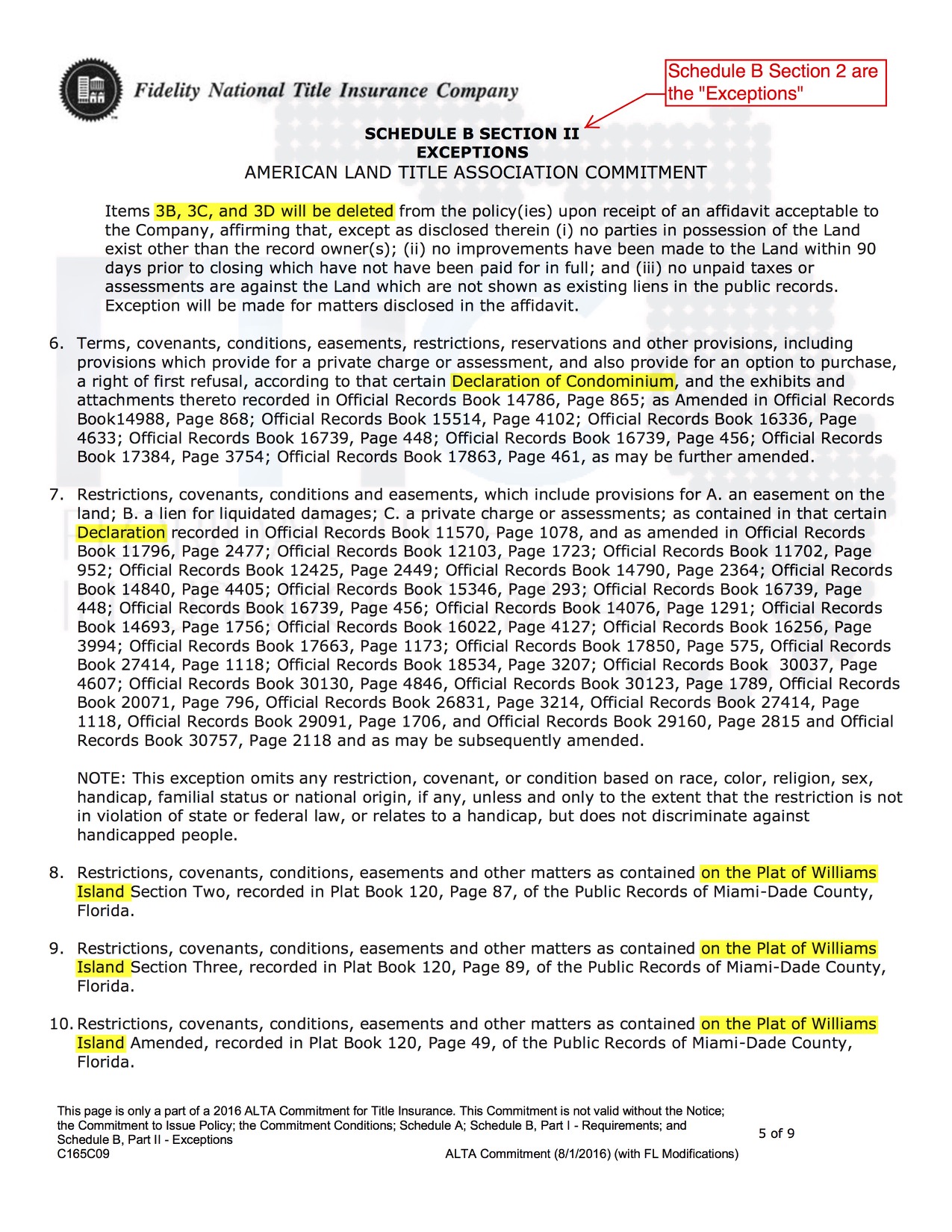

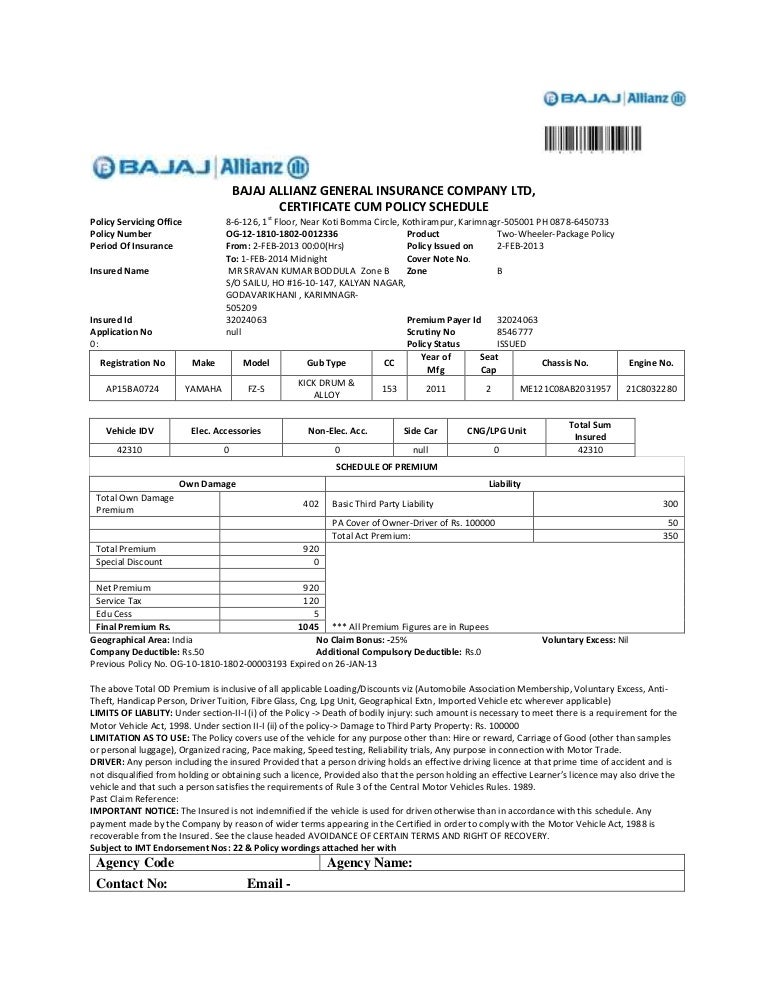

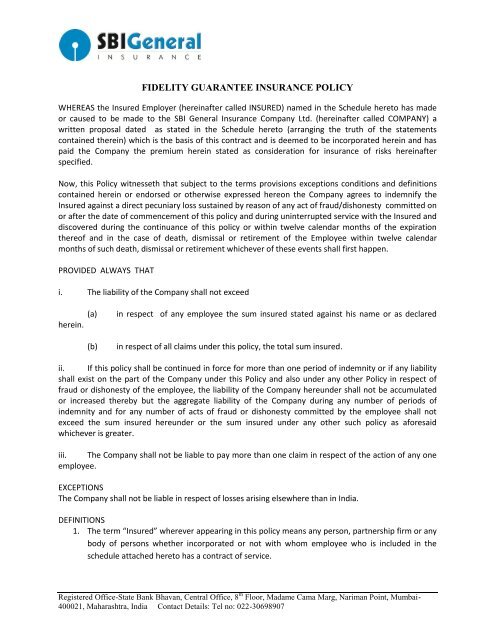

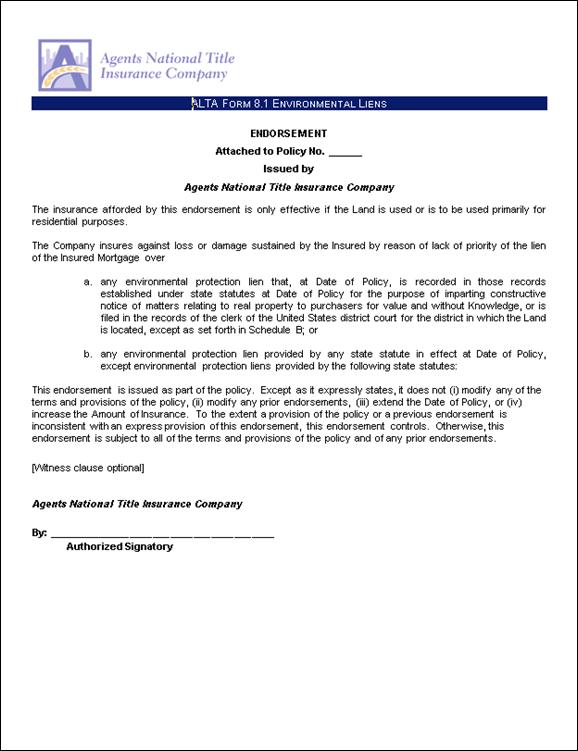

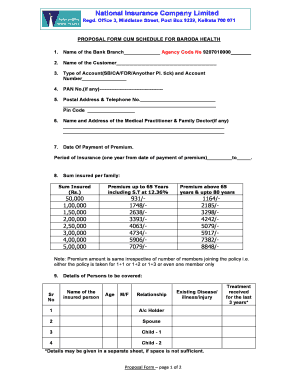

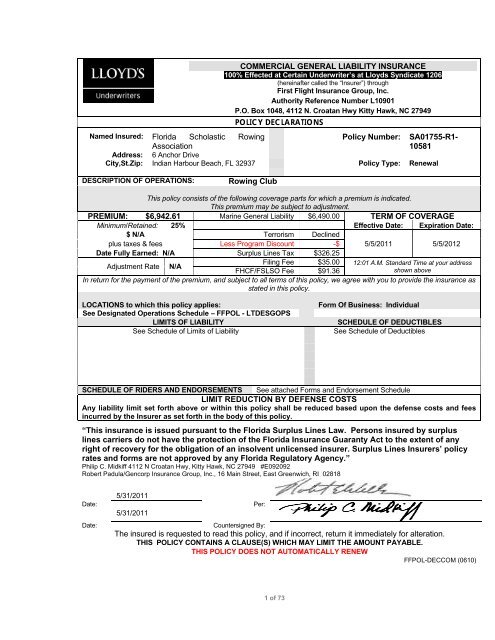

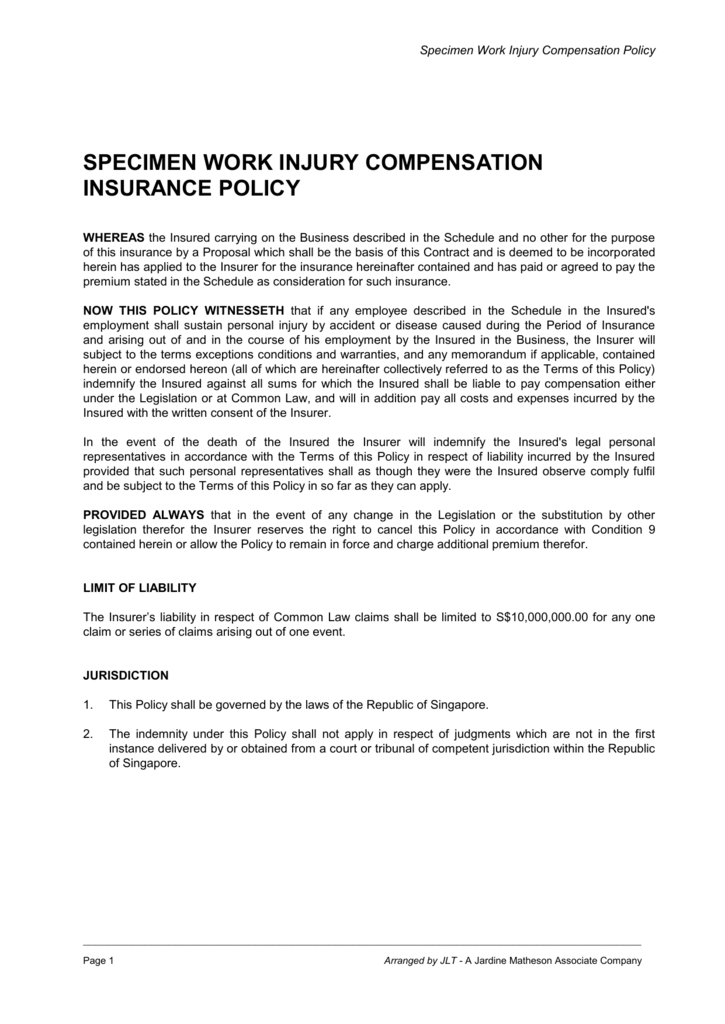

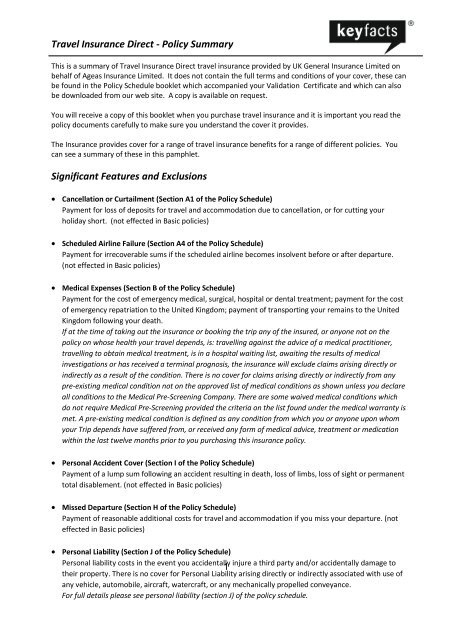

Insurance policy schedule. Evidence of insurability means the information we use to determine if a life insured is eligible for insurance. Scheduled personal property and canine liability exclusion. In insurance the insurance policy is a contract generally a standard form contract between the insurer and the insured known as the policyholder which determines the claims which the insurer is legally required to pay. 12 insurance policy templates an insurance policy template is a legal document itemizing the terms and conditions of an agreement of insurance which is issued by an insurance company to an insured.

C2016 chubb insurance australia limited. The purpose of a schedule of insurance is to clarify for the insurer and the insured exactly what is covered. It is very important for everyone to read and understand insurance policy before accepting it and signing on it. Your coverage option is specified in the policy schedule.

The schedule may also include the exact benefits premiums and other costs associated with the policy. Your insurance schedule is an important document that sets out the information youve given us on which weve based our decision to insure you as well as the individual details of your policy. When you have supplied the insurer with all of the required information received the product disclosure statement pds and paid your premium you will be issued with a document that confirms you are the holder of a particular insurance policy. Policy schedule is also known as a schedule of insurance.

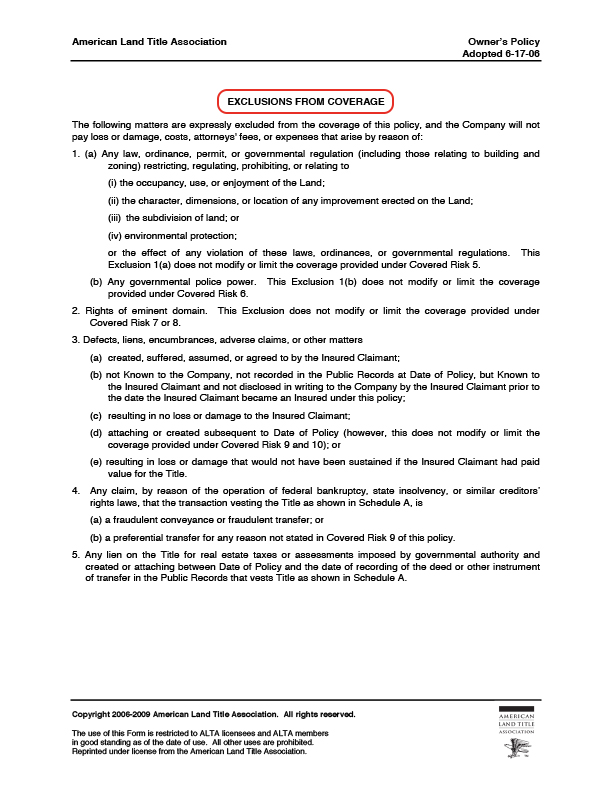

Benefit and insurance plan are specified in the policy schedule. Elite ii professional indemnity insurance policy schedule and wording ed. It is the part of the insurance contract that identifies the policyholder and details the property and persons covered the amount of coverage the exclusions the deductibles and the payment mode and schedule. Your disability critical illness involuntary unemployment and involuntary loss of self employment coverages start on the 31st day after the effective date of insurance.

There are many types of insurance schedules from additional people covered on your policy to types of windstorm damage your insurer cant cover and even coverage for different types of mold seriously. Your spouses life and accidental death coverage begins on the spousal effective date of insurance. Two of the most common types of schedules have to do with add ons and exclusions to the basic renters or homeowners policy. Chubb its logos and chubbinsured are protected.

In exchange for an initial payment known as the premium the insurer promises to pay for loss caused by perils covered under the policy language.