Liability Insurance Meaning

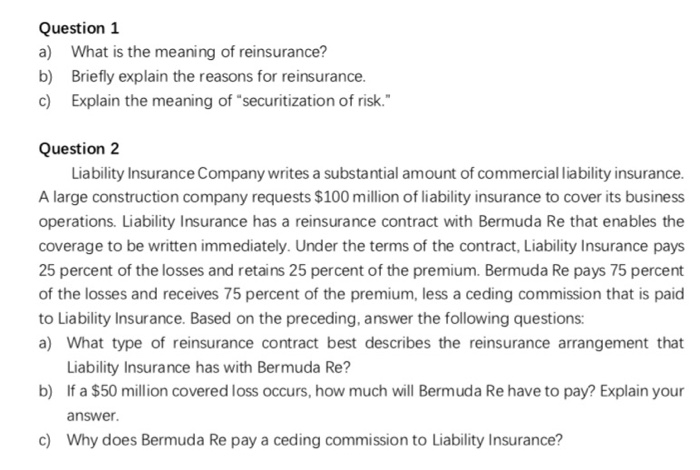

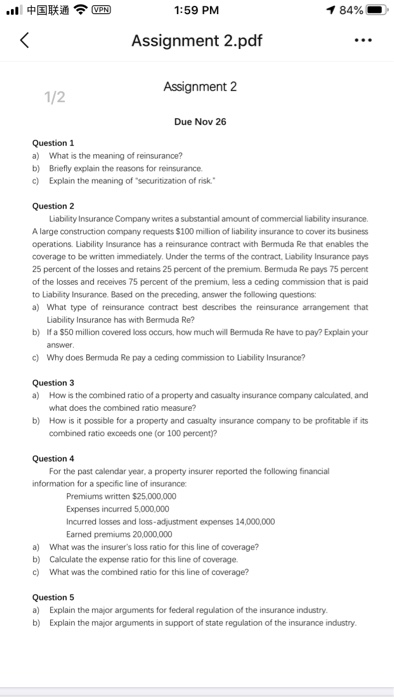

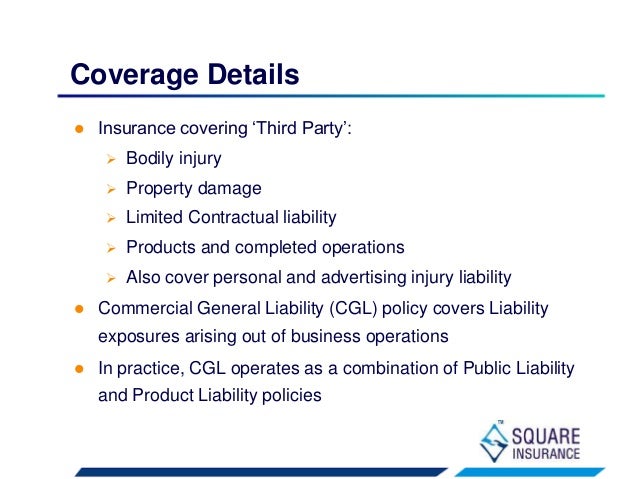

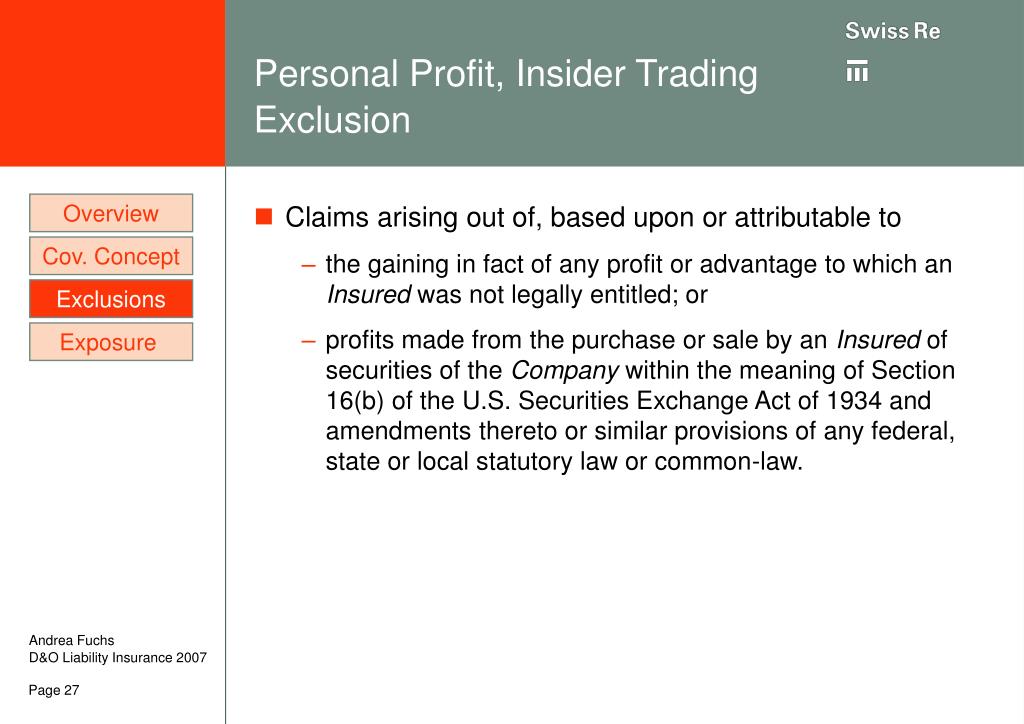

More specifically a typical policy will provide indemnity to the insured against loss arising from any claim or claims made during the policy period by reason of any covered.

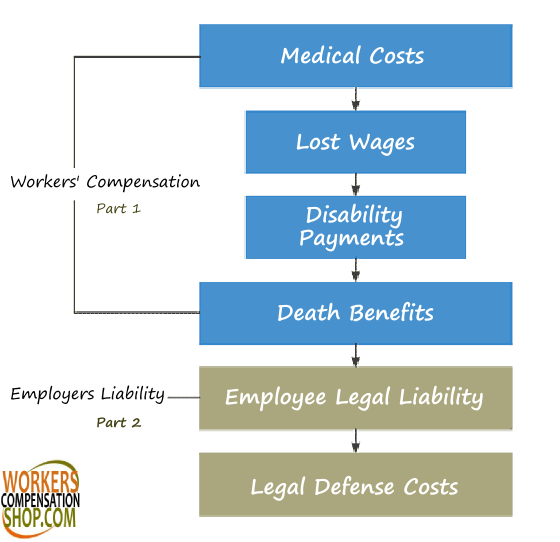

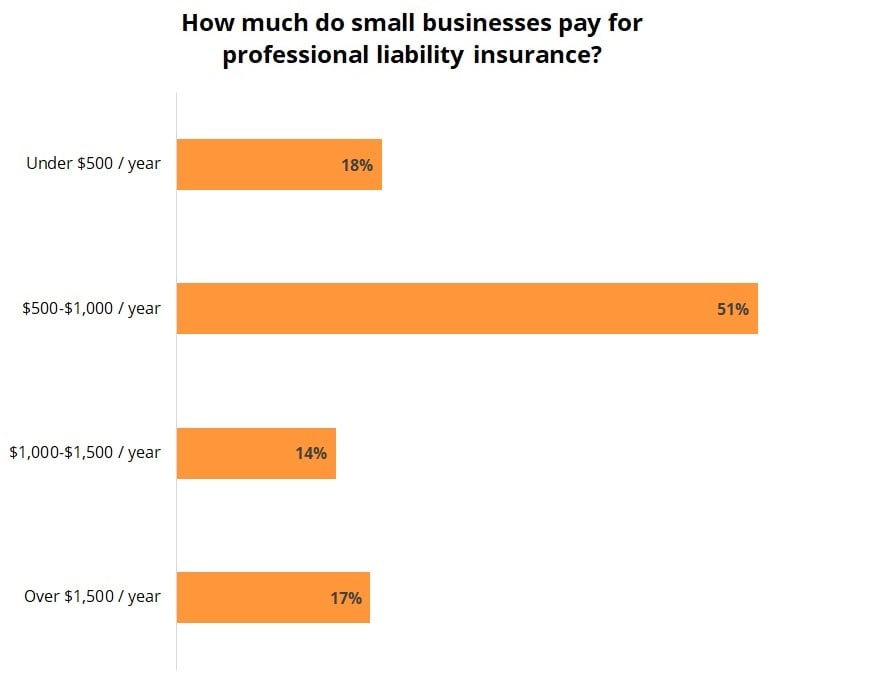

Liability insurance meaning. Employers liability insurance protects employers from financial loss if a worker has a job related injury or illness not covered by workers compensation. If you have employees you will usually be required by law to have employers liability insurance to cover injury claims made by employees. Policy that covers civil liabilities to third parties arising from bodily injury property damage or other wrongs due to the action or inaction of the insured. Professional liability insurance policies are generally set up based on a claims made basis meaning that the policy covers only those claims made during the policy period.

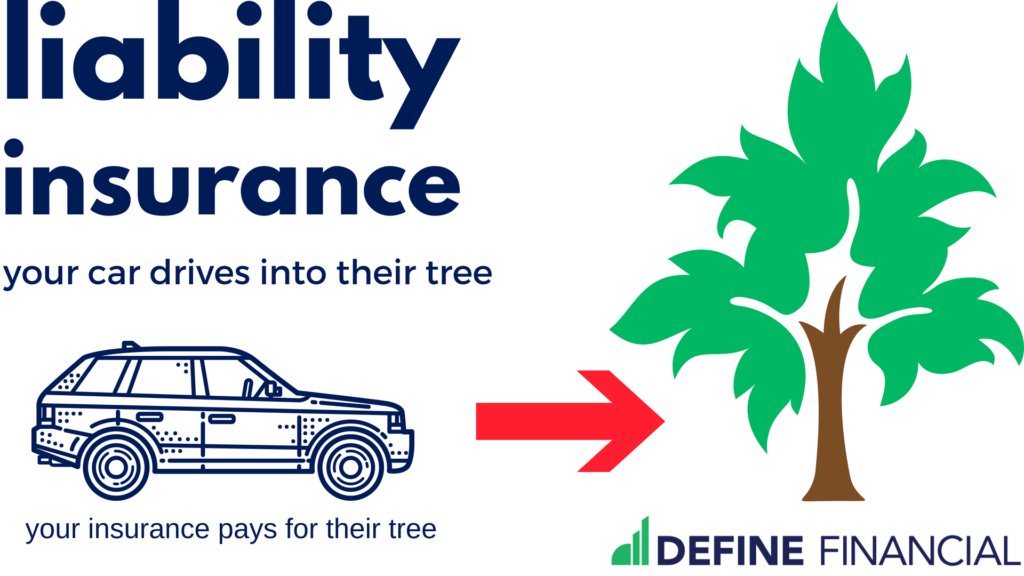

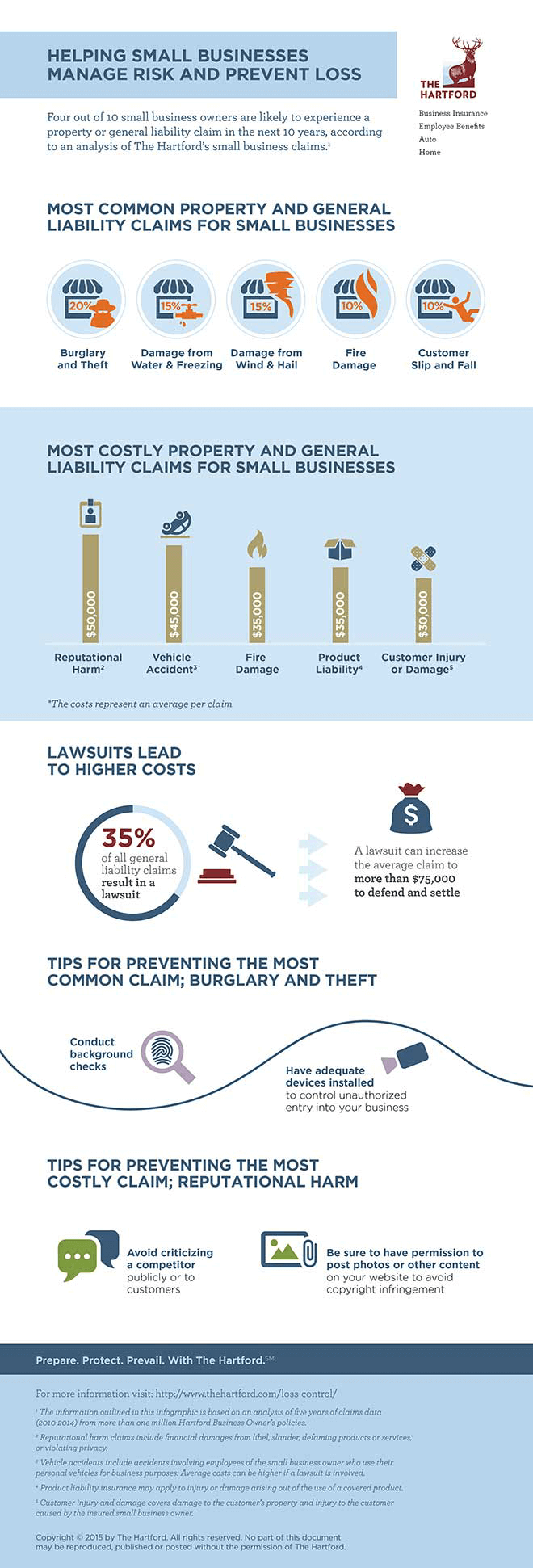

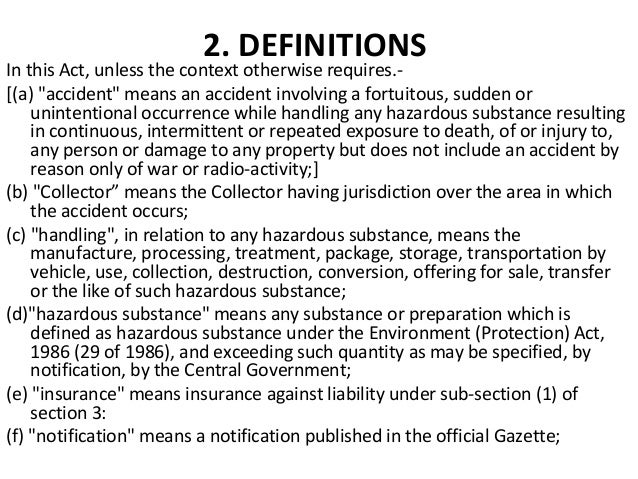

Liability insurance also called third party insurance is a part of the general insurance system of risk financing to protect the purchaser the insured from the risks of liabilities imposed by lawsuits and similar claims and protects the insured if the purchaser is sued for claims that come within the coverage of the insurance policy. It covers only civil liabilities and not criminal liabilities. Originally individual companies that faced a common. Liability insurance is any insurance policy that protects an individual or business from the risk that they may be sued and held legally liable for something such as malpractice injury or negligence.

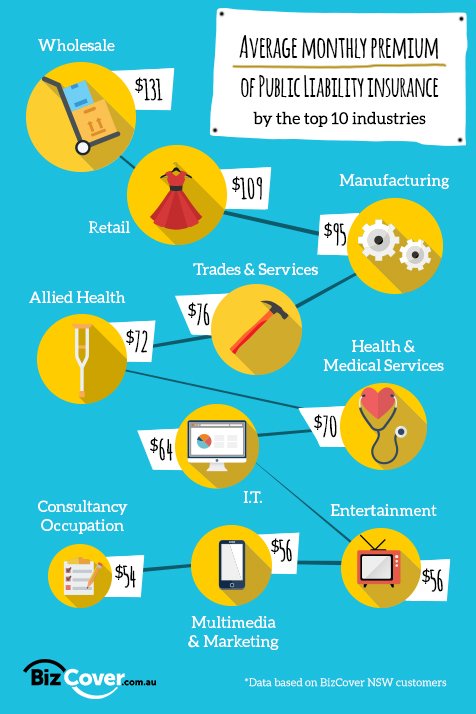

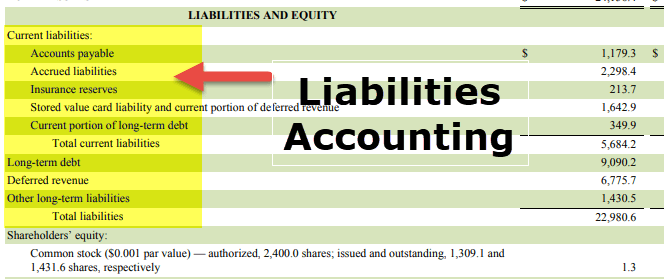

Public liability insurance definition is insurance to protect businessmen as owners or landlords against loss due to legal liability for injury or damage to the persons or property of the public. Liabilities are settled over time through the transfer of economic. A liability is a companys financial debt or obligations that arise during the course of its business operations. Employers liability insurance can be.

Public liability insurance is the uk name for business insurance that covers third party injury or damage claims while in the usa this insurance cover is called general liability insurance.

/Clipboard01-5c7005ccc9e77c0001ddce7a.jpg)