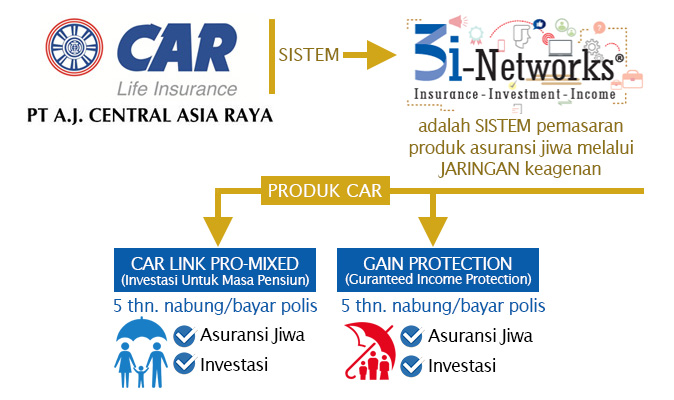

Life Insurance Income Protection

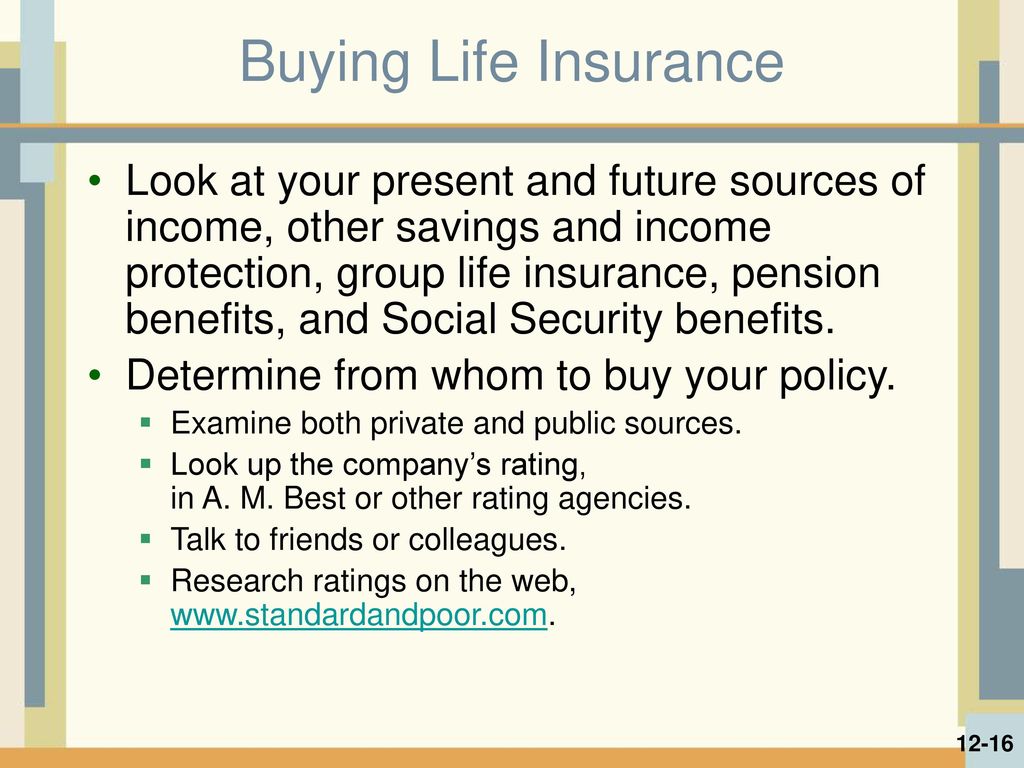

Discover some of the highest rated direct life insurance and income protection insurance policies on the canstar database based on our annual life insurance star ratings and direct income protection star ratings.

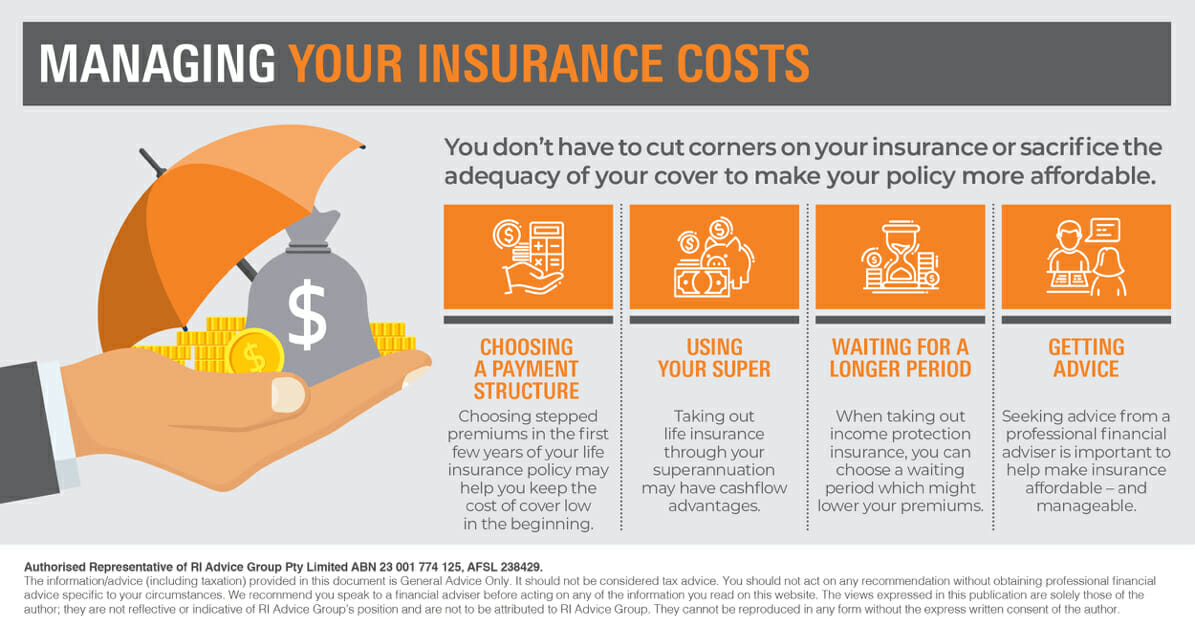

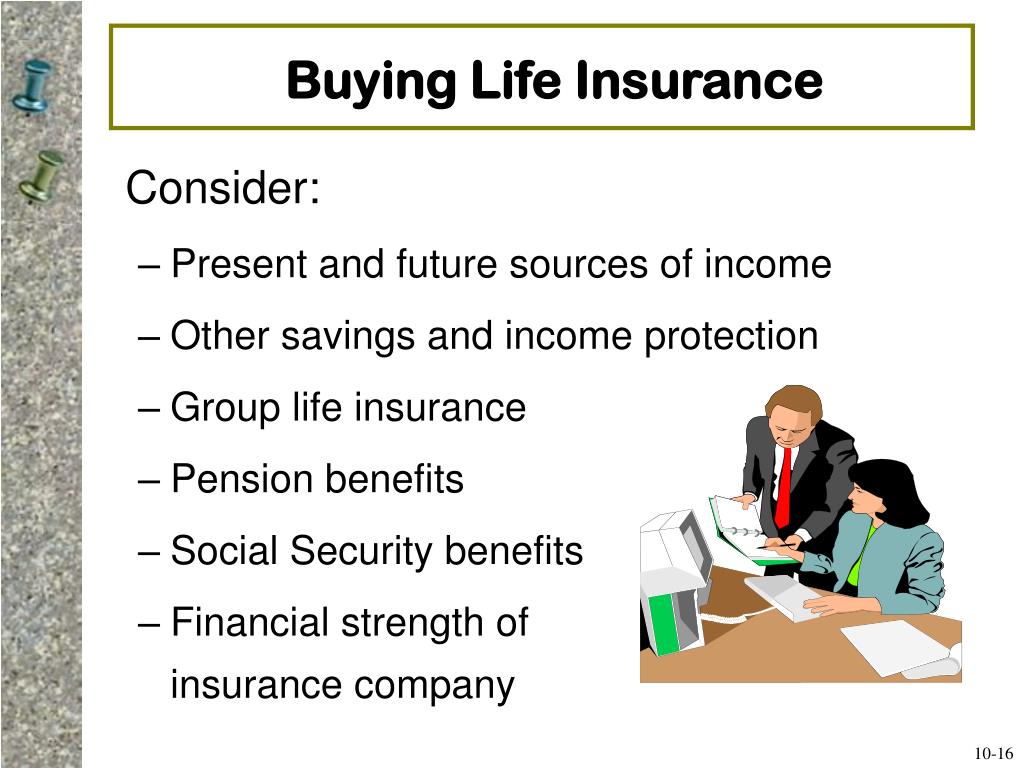

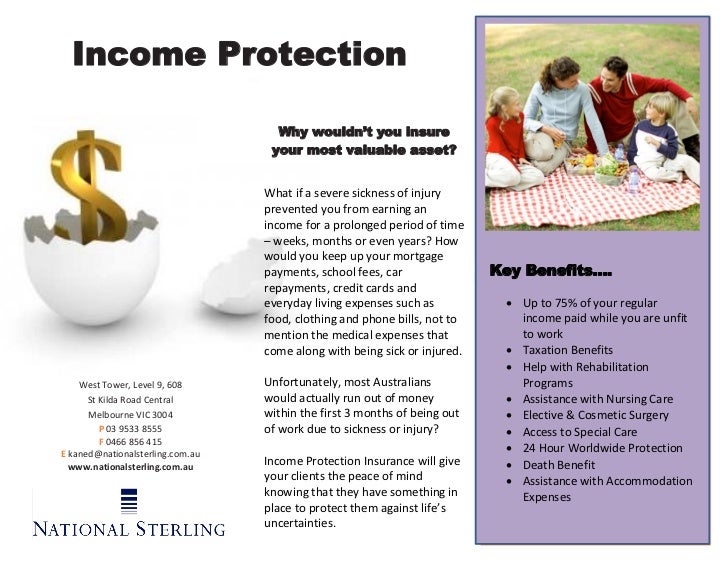

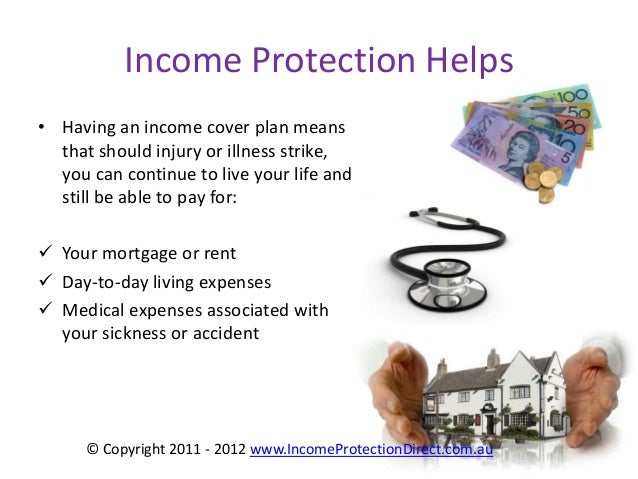

Life insurance income protection. Income protection insurance pays you a benefit if you are unable to work for a period of time because of illness or injury. With life insurance and income protection there are no medical tests when applying. Canstar compares life insurance providers to help you find the right policy for you. Life income protection.

If youre fired for something bad youve done or if you leave the job without another one lined up your policy most likely wont pay out. The maximum cover that pinnacle life can provide under our income protection cover is 75 of your income. If acc are replacing 80 of your income your income protection cover wont top you up to 100 however if you are receiving less than 75 from acc we may be able to top you up to 75. Life insurance and income protection.

Were here to help to learn how please visit our dedicated covid 19 information page. While life insurance might be the first protection policy that springs to mind when you have children. Yes income protection insurance covers you if you lose your job provided you lose it through no fault of your own. Life insurance can help provide financial support to your loved ones if you were to pass away or become terminally ill.

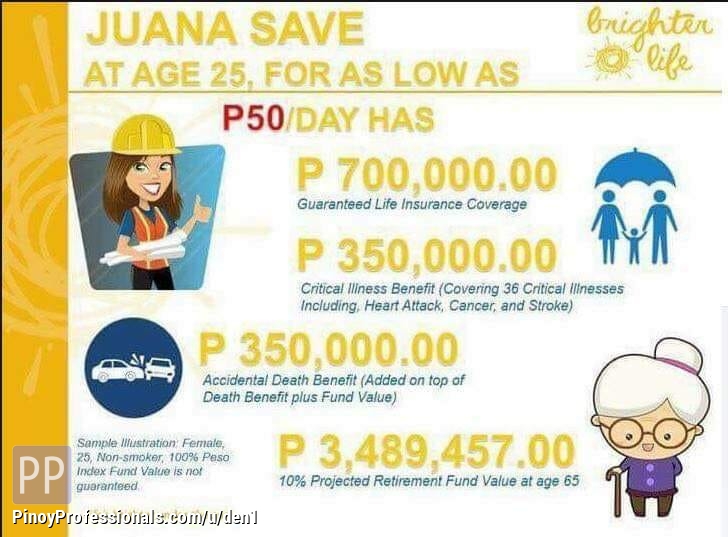

Income protection may pay a death benefit in the event the person who holds the policy dies but its main function is to insure your income not your life. Income protection quote how to get a callback fill in the required fields below and an irish life financial services advisor can call you back to look at all your options answer your questions and see what protection plan may suit your life cover needs. If you become sick or injured and unable to work income protection cover can help cover most of your expenses and keep your life on track. Real insurance is a leading provider of award winning affordable life insurance for singles and families.

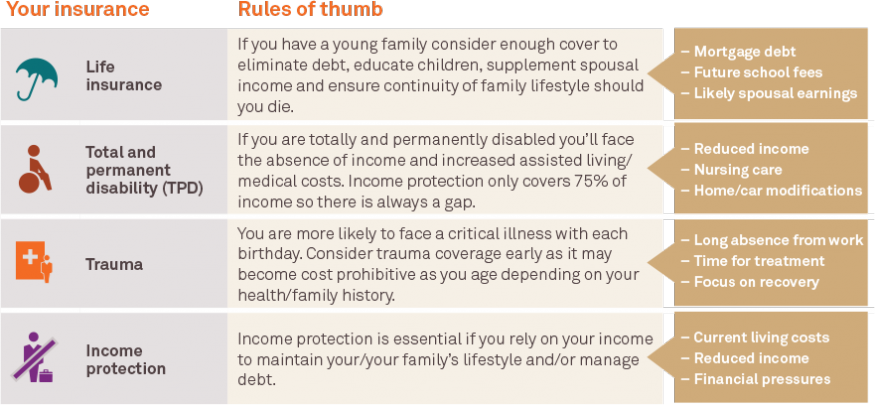

Income protection insurance and life insurance can assist with protecting you and your family if the unexpected happens. Total and permanent disability tpd insurance pays a lump sum of cash if you become permanently disabled and will be unable to work because of illness or injury in either your own or.