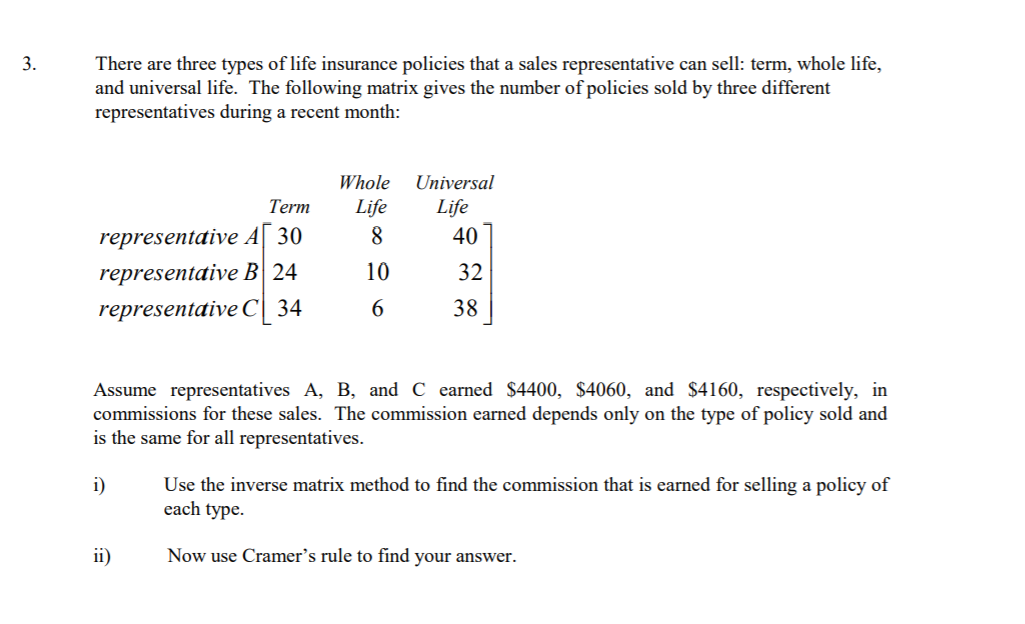

Life Insurance Policy Types

Here youre buying a policy that pays a stated fixed amount on your death and.

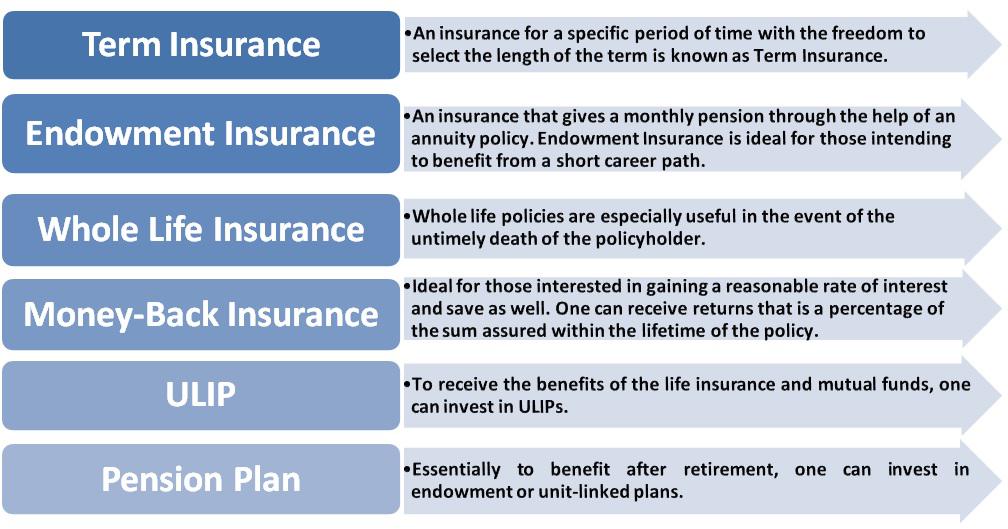

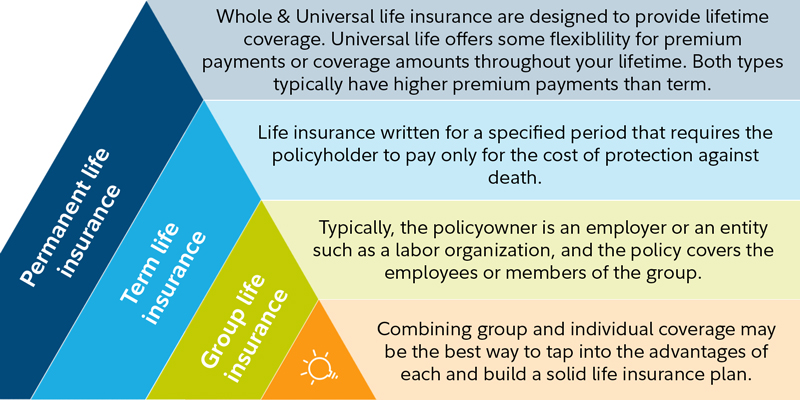

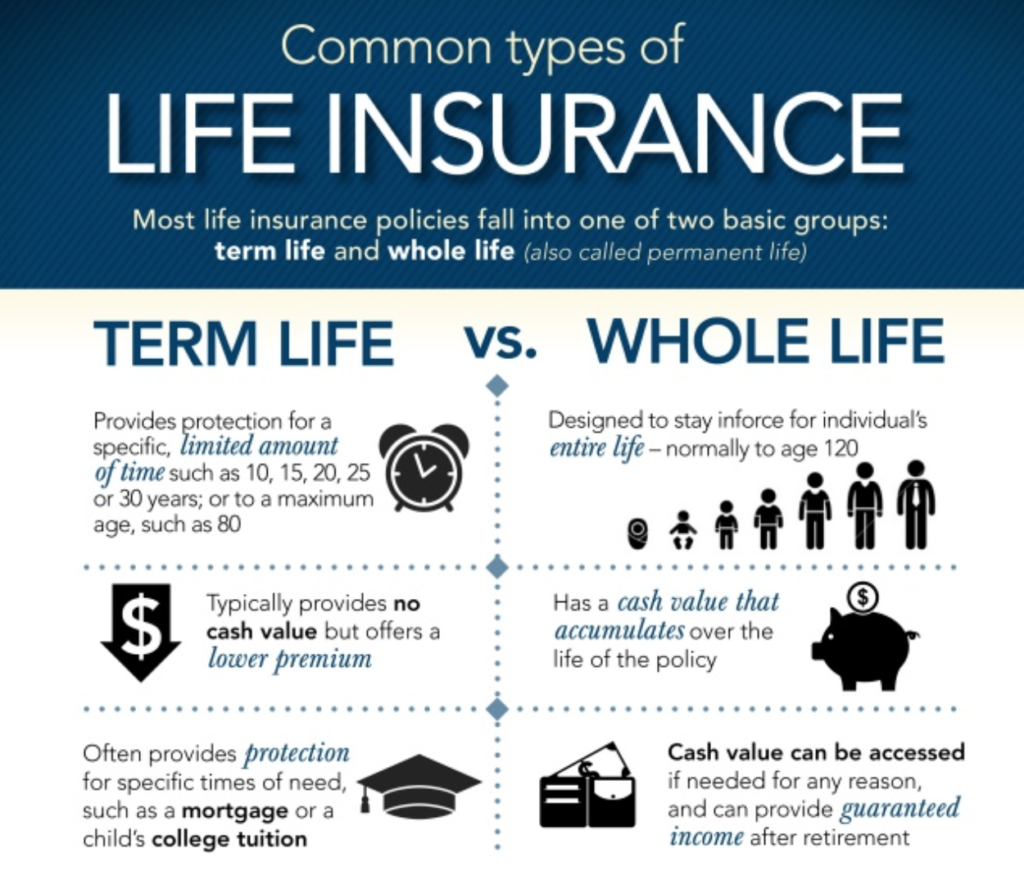

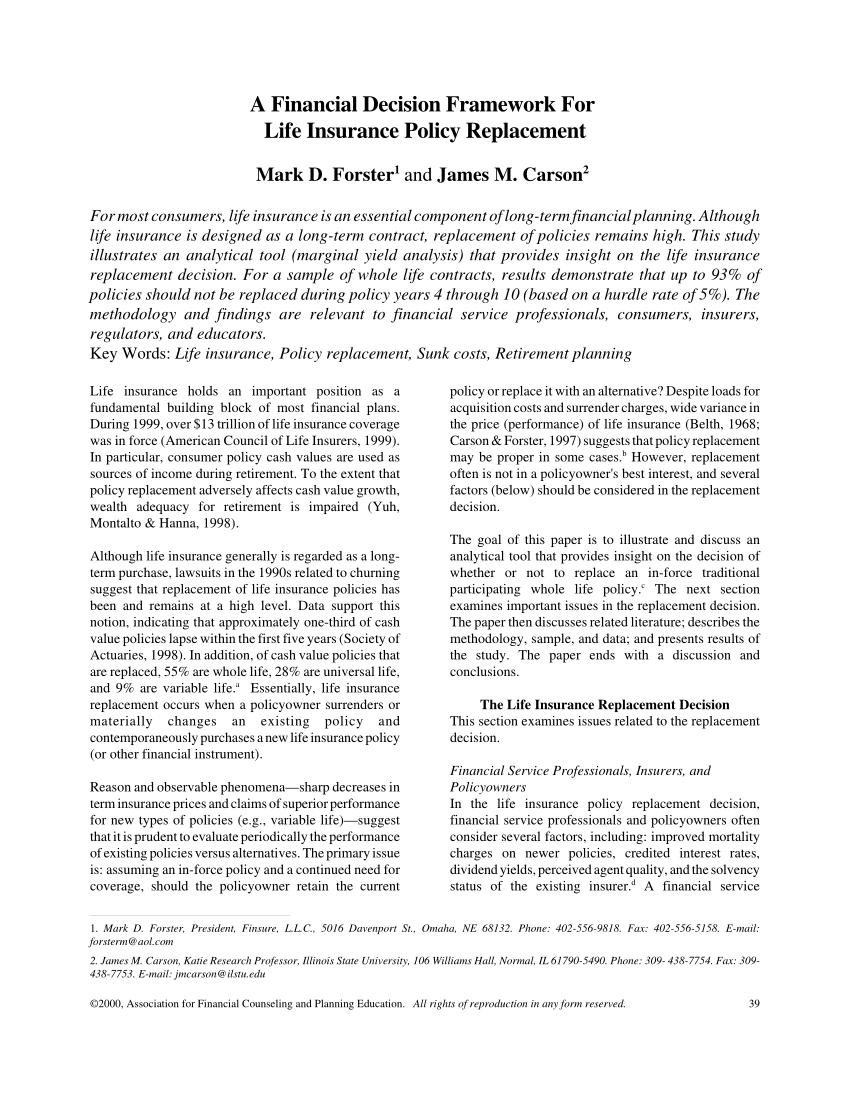

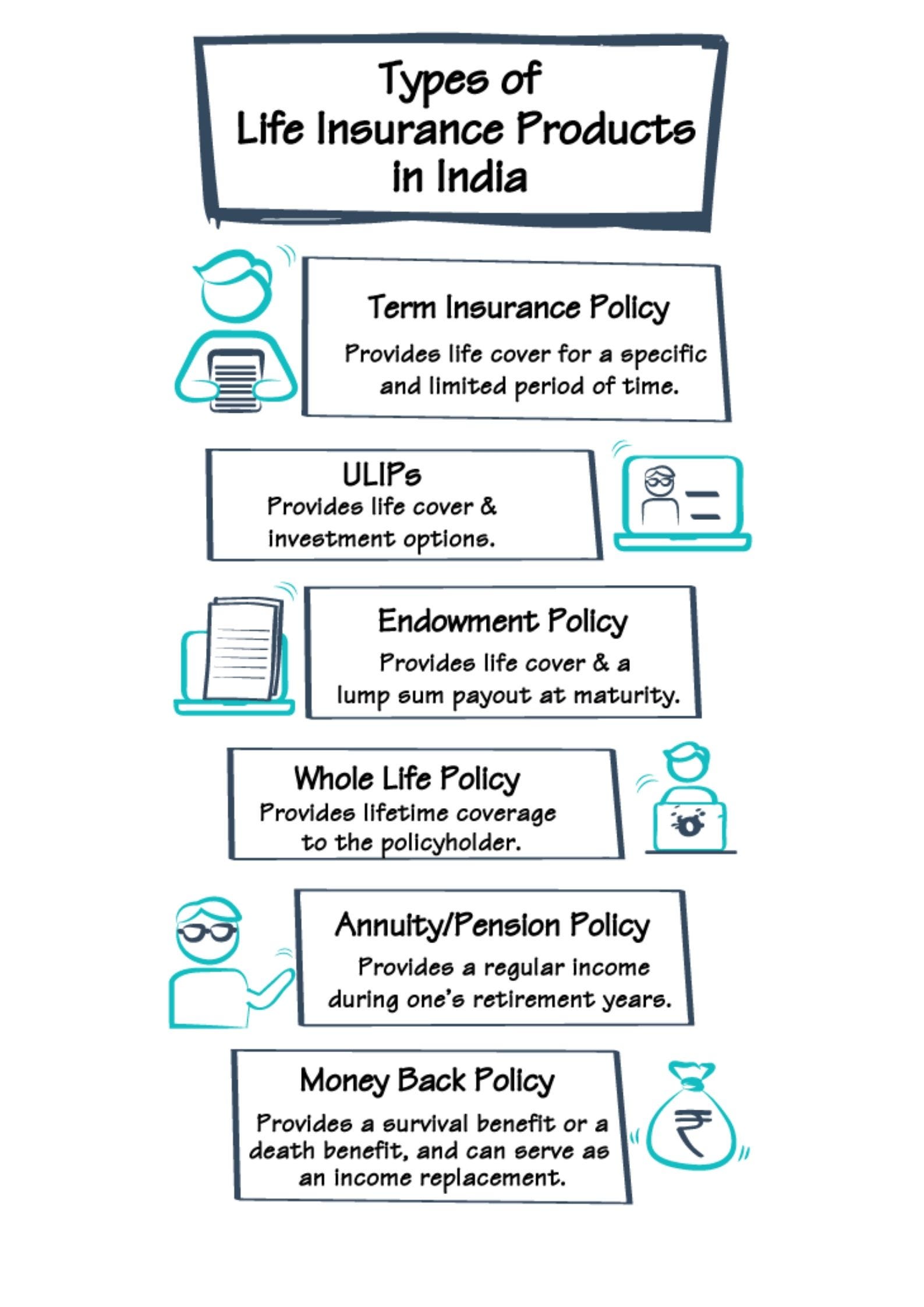

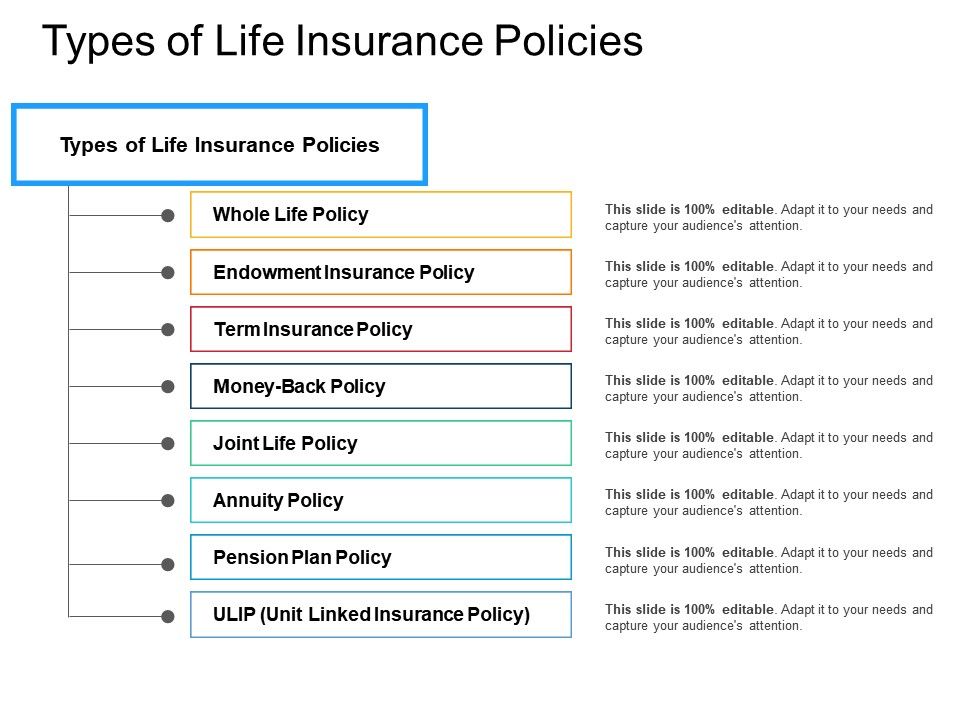

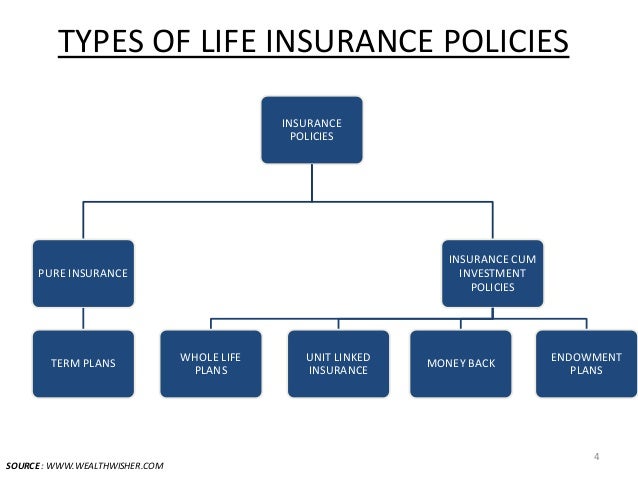

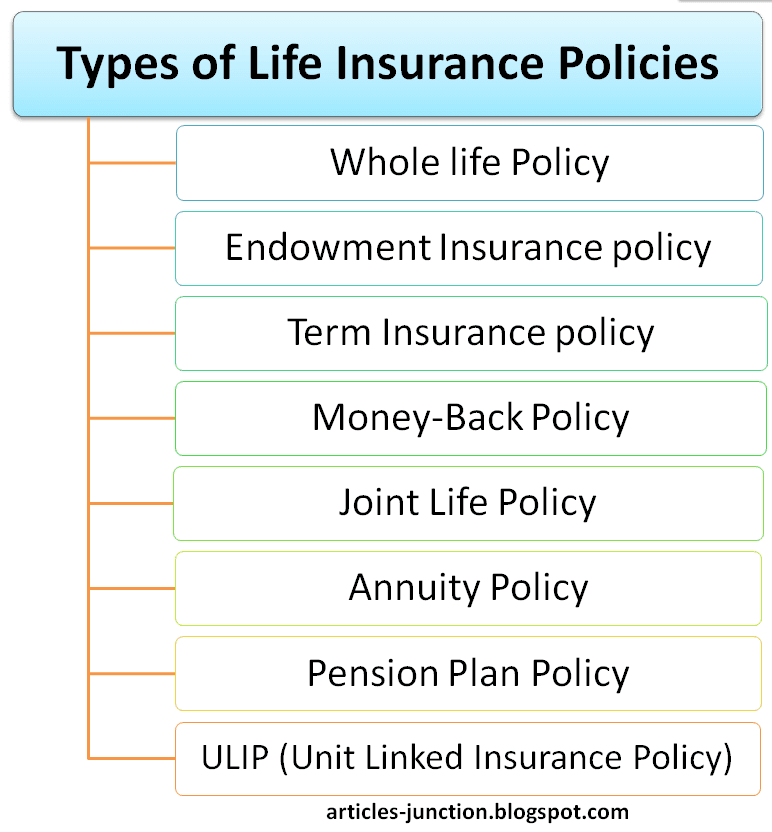

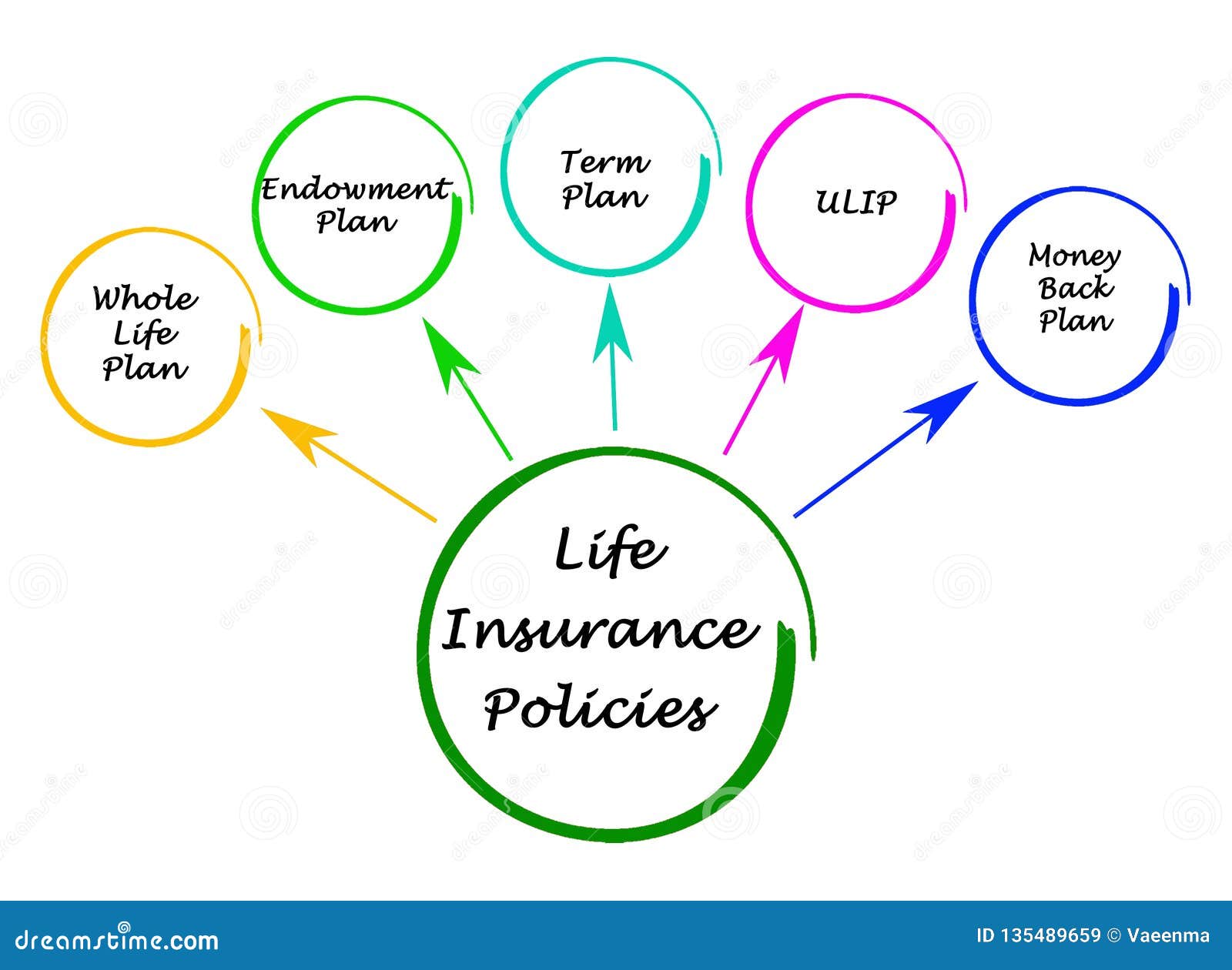

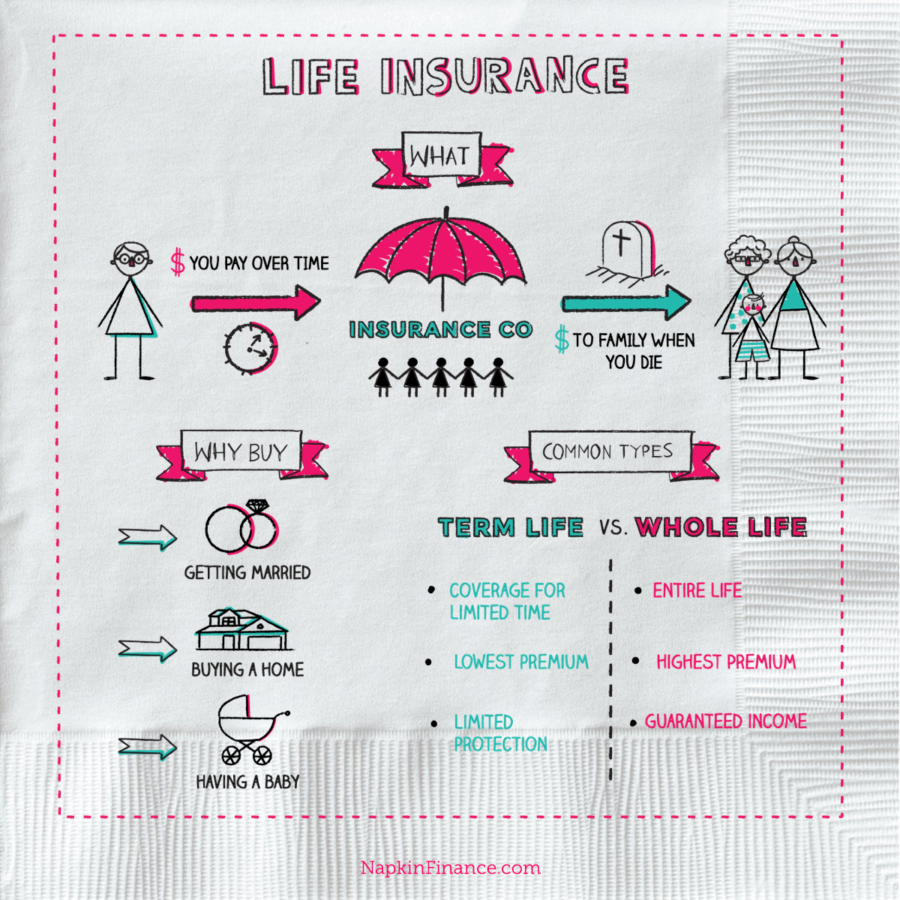

Life insurance policy types. It provides death benefit protection for 10 15 20 25 or 30 years depending on the company and what you choose. They expire at the end of the term which can last up to 30 years. Broadly speaking life insurance can be further categorized as a pure risk coverage plan purely insurance and the other which is a combination of insurance and investment component. Pays out upon the death of the first person whichever one it is.

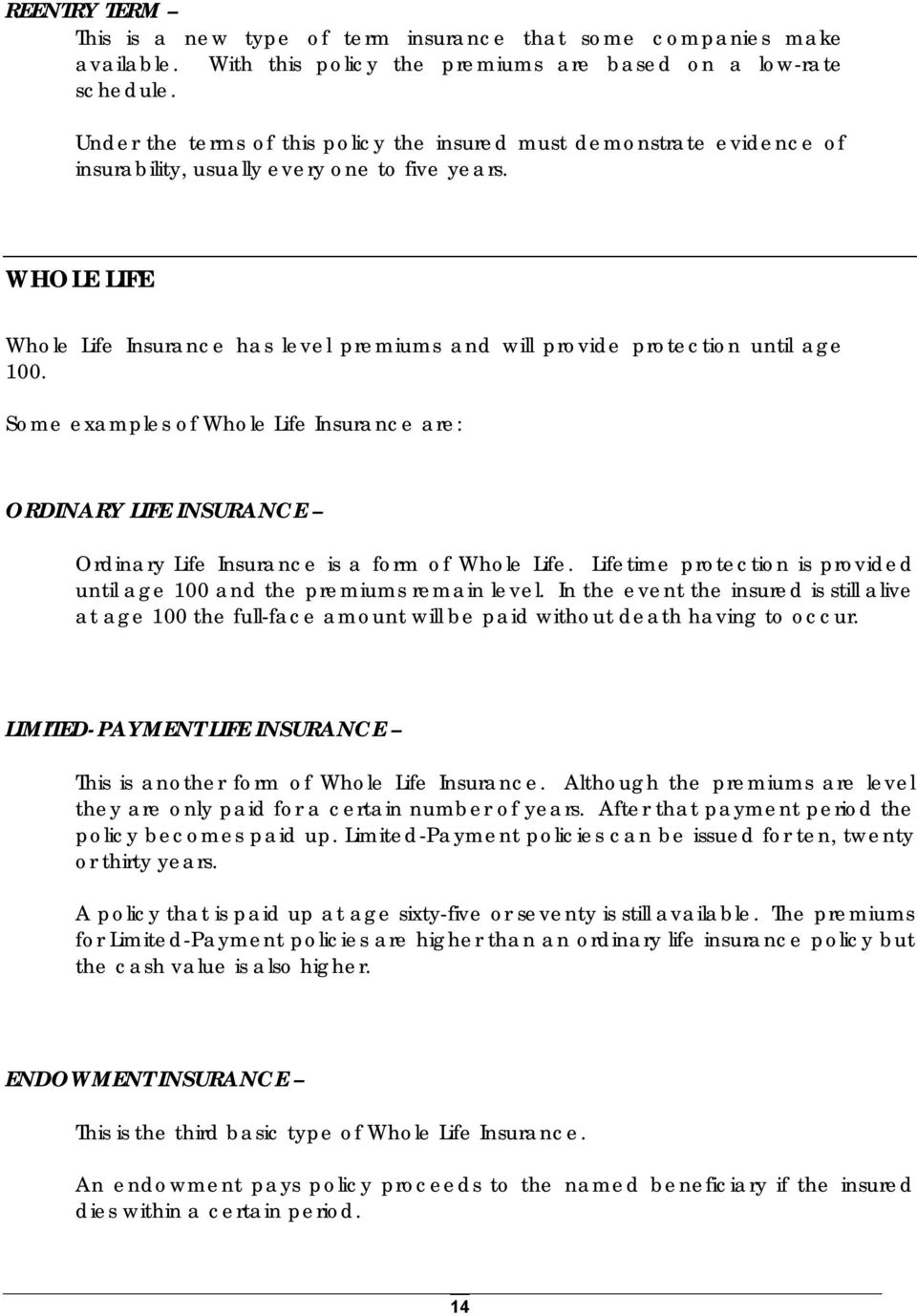

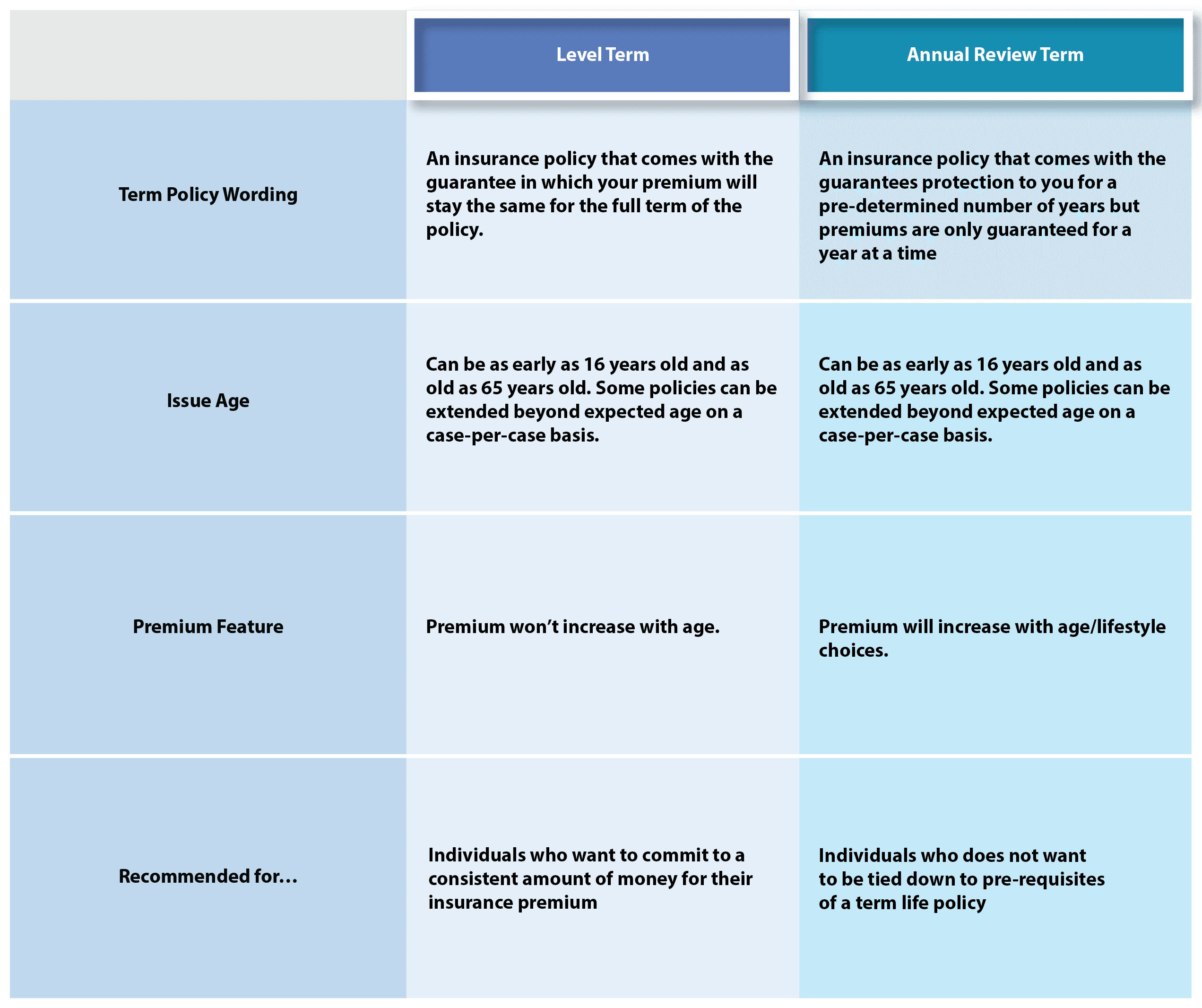

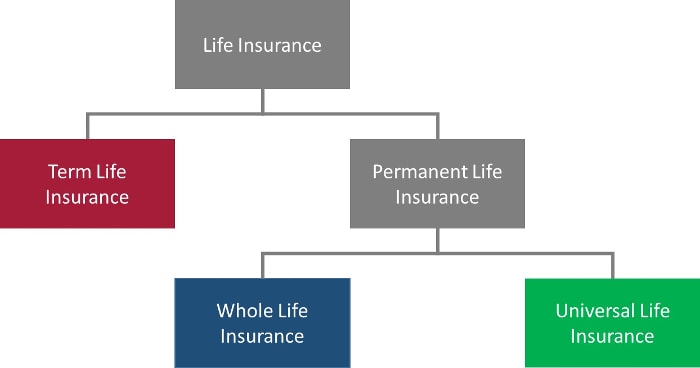

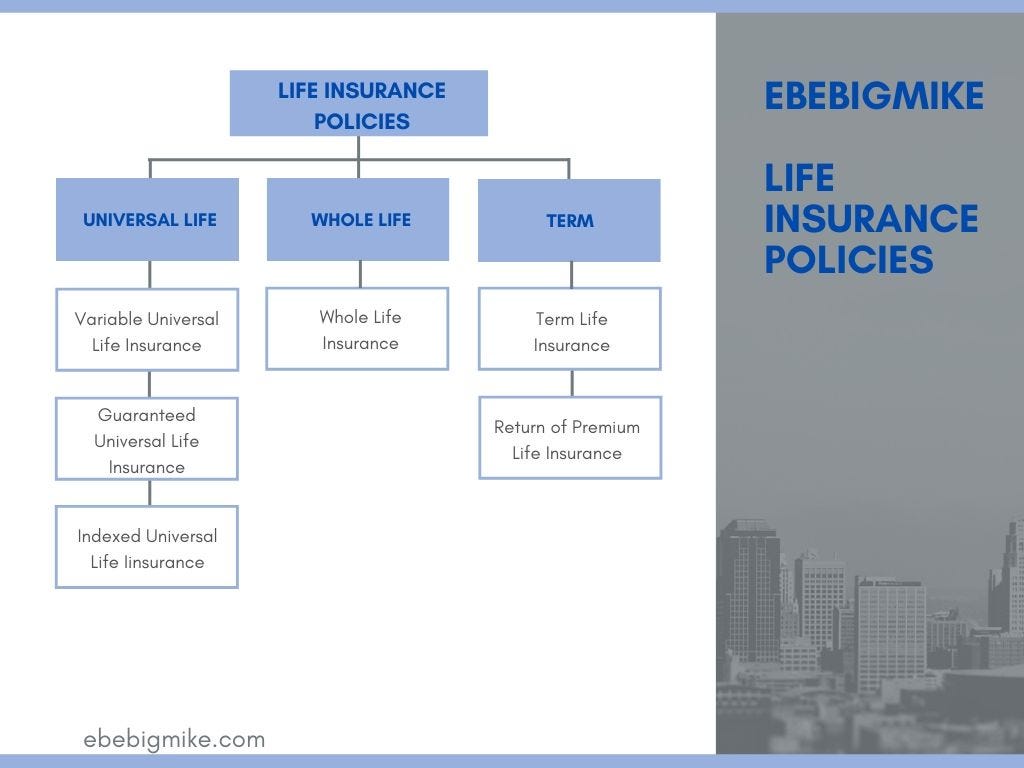

Term life insurance is the first of the two major types. Whole life policies a type of permanent insurance combine life coverage with an investment fund. Indexed universal life insurance is a type of universal life insurance policy that allows the policy owner to choose to invest the policys cash value. The life insurance company offers one or more investment options designed to match the growth rate of a well known index such as the sp 500 or nasdaq 100.

Depending on the contract other events such as terminal illness. These types of life insurance policies offer a death benefit as well as a cash component. Know the various life insurance plans to select the right one at the right time. However with variable life insurance the policyholder can take part in a variety of different investment options such as equities.

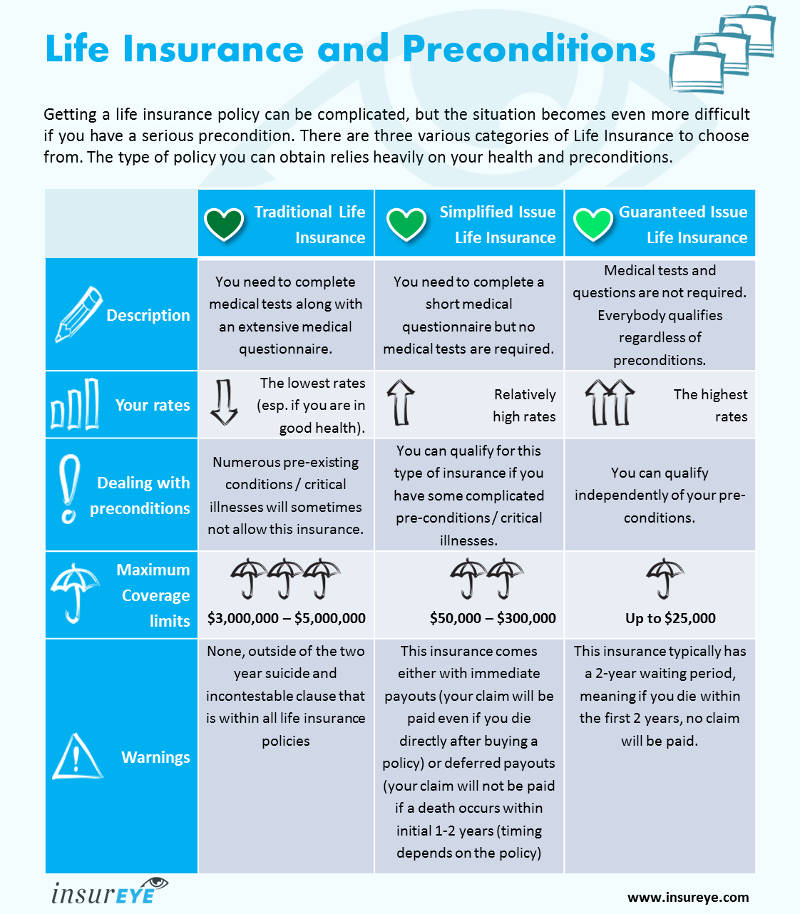

This type of life insurance insures two lives usually those of spouses under one policy. A whole of life insurance policy offers protection for your lifetime from the moment you take cover out until you die when there will be a guaranteed pay out. Term life insurance is a type of life insurance that provides a death benefit to the beneficiary only if the insured dies during a specified period. Heres a brief guide to different types of life insurance policies.

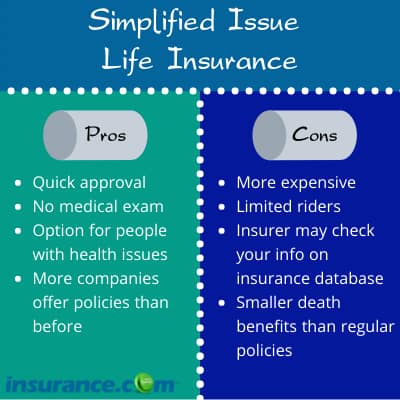

Term life insurance policies are more affordable than other types of life insurance policies usually costing between 30 40 a month for a 30 year 500000 policy for healthy people in their 20s and 30s. Life insurance or life assurance especially in the commonwealth of nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policy holder. As you might expect this type of life insurance is much more expensive than other types of policy which last for a set time period.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)