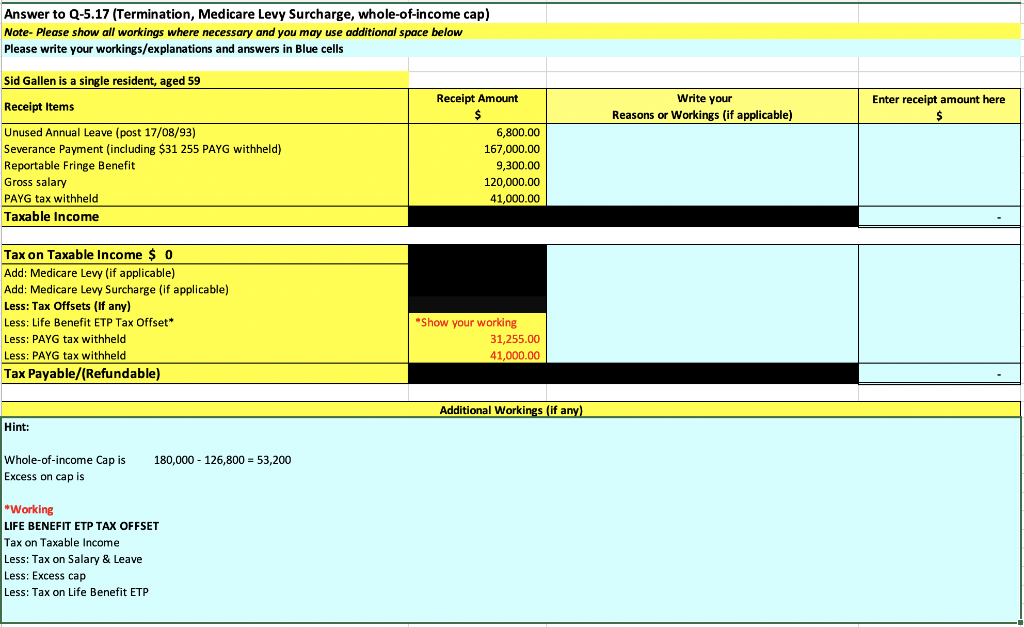

Medicare Levy Surcharge

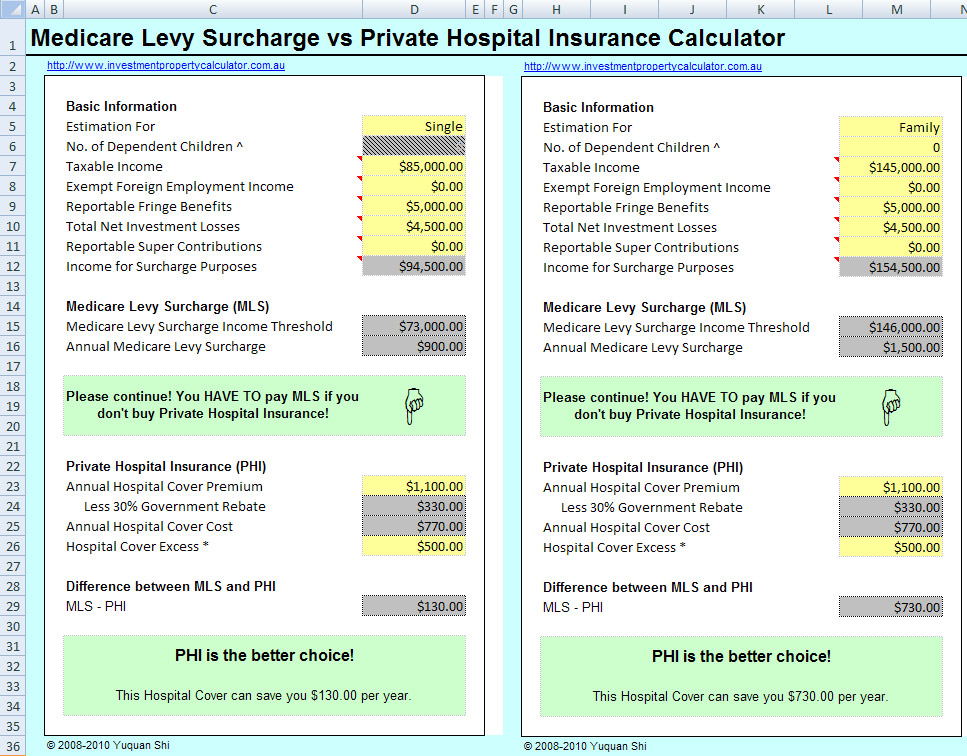

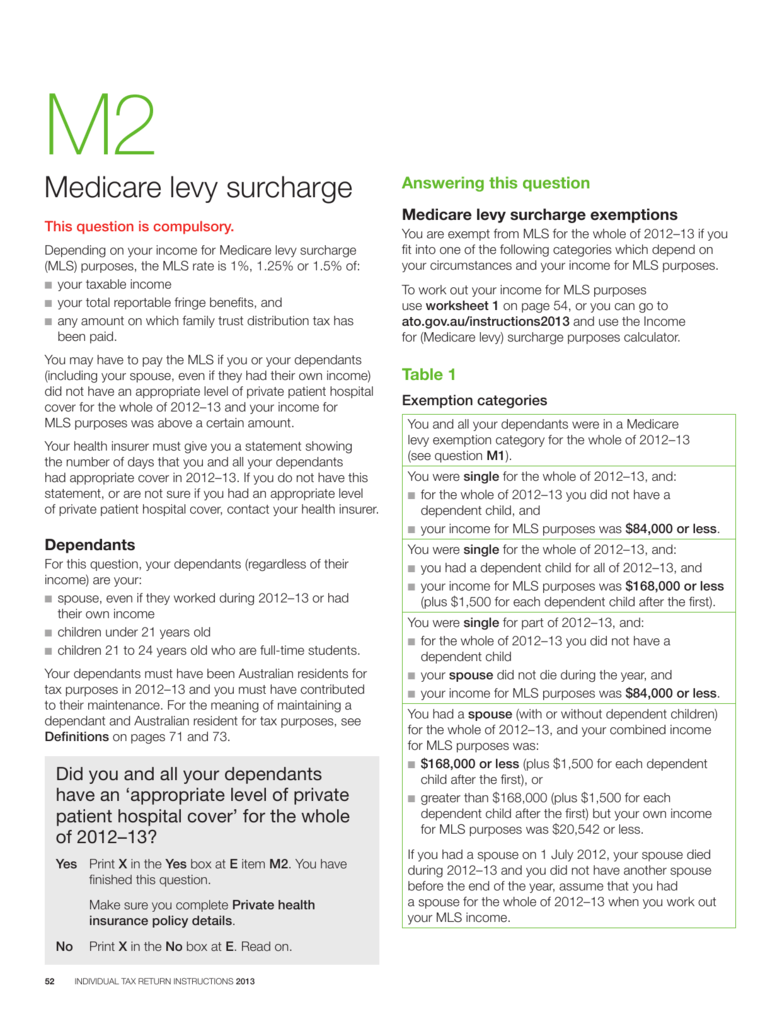

The medicare levy surcharge mls is levied on australian taxpayers who do not have an appropriate level of private hospital insurance and who earn above a certain income.

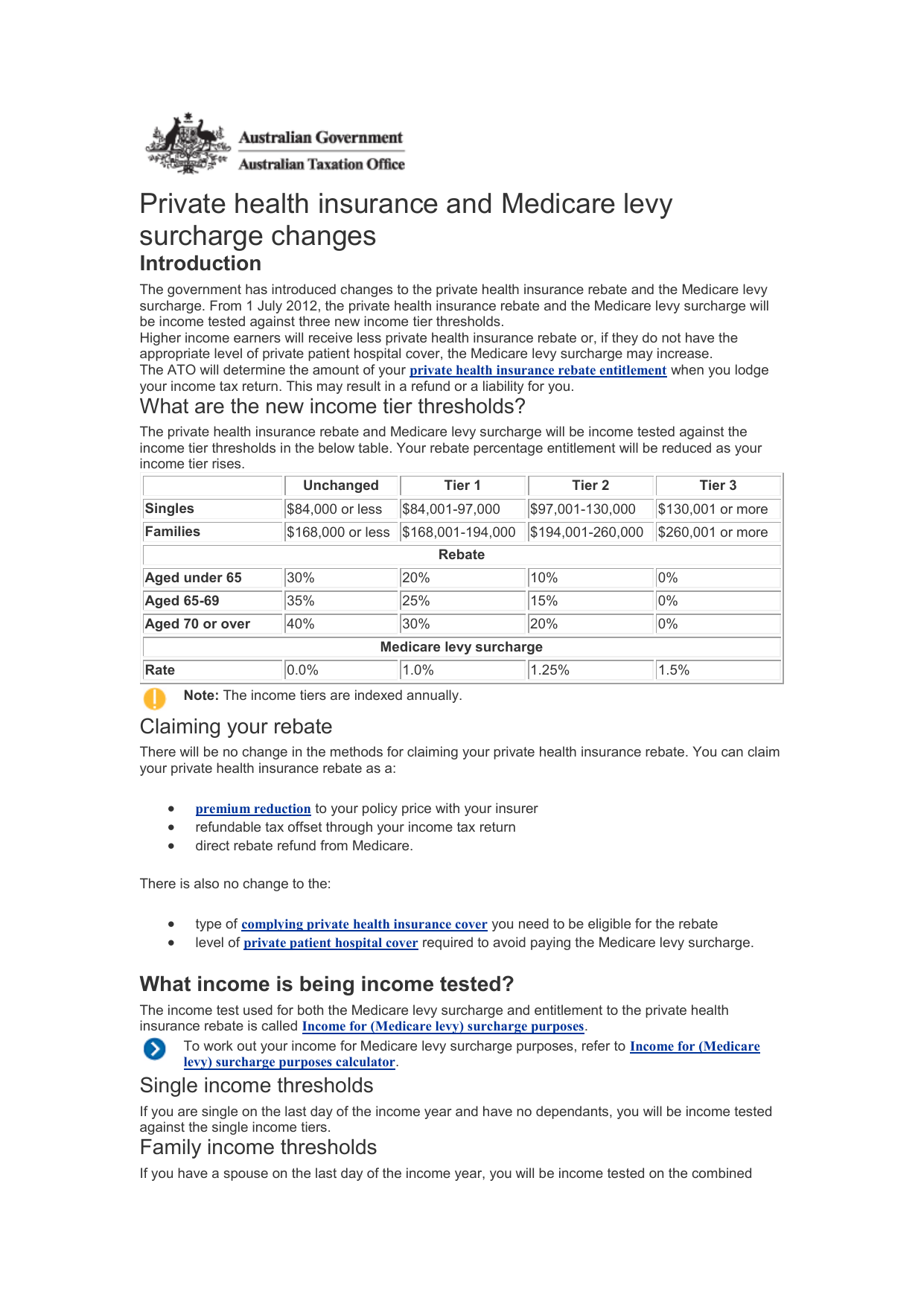

Medicare levy surcharge. The medicare levy surcharge mls was introduced on 1 july 1997 as a means to encourage those on higher incomes to take out private hospital cover. The medicare levy surcharge is an additional tax on top of the medicare levy. The first is the medicare levy and the second is the medicare levy surcharge. It is designed to encourage individuals to take out private patient hospital cover and to use the private hospital system to reduce demand on the public medicare system.

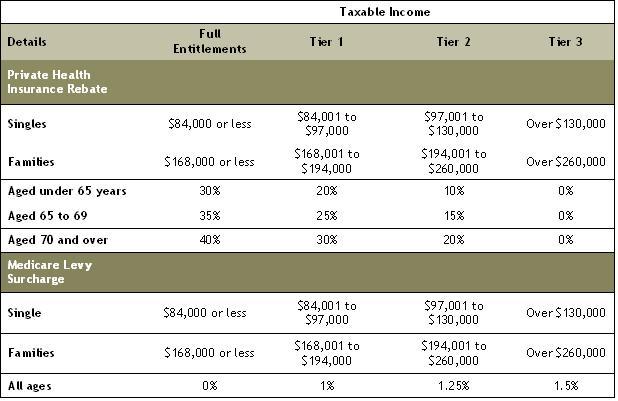

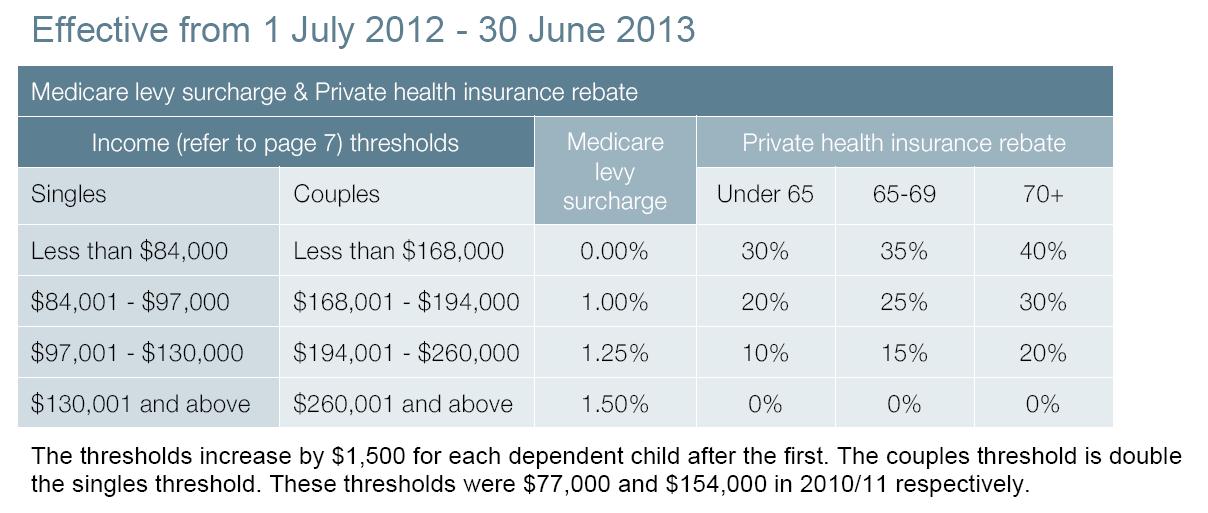

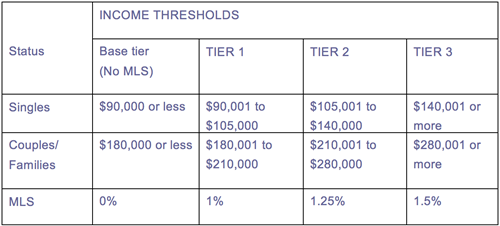

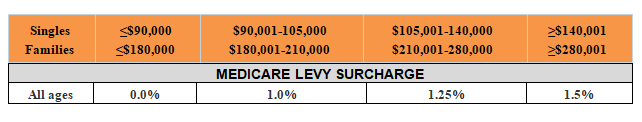

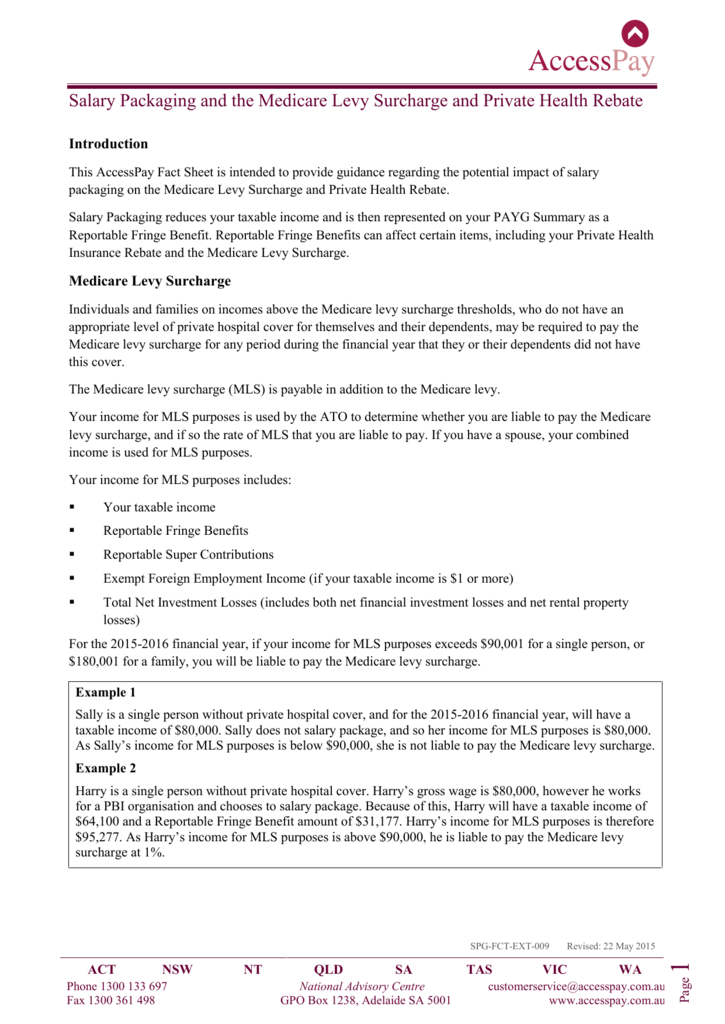

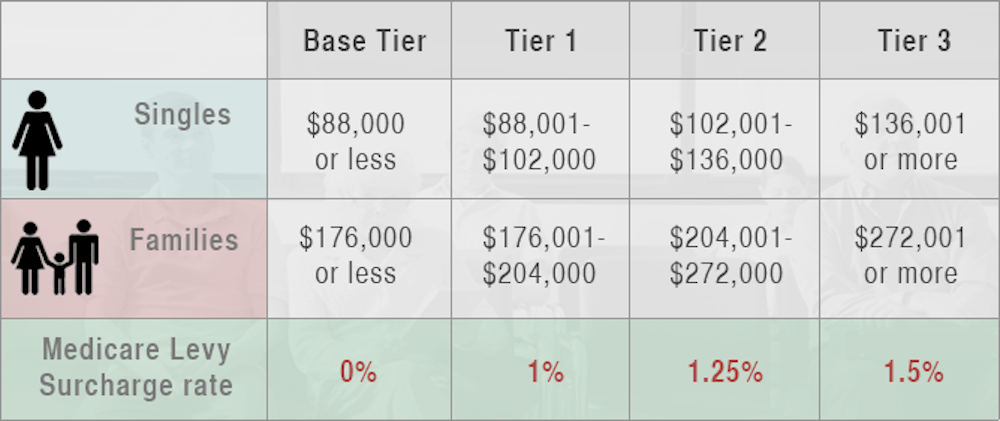

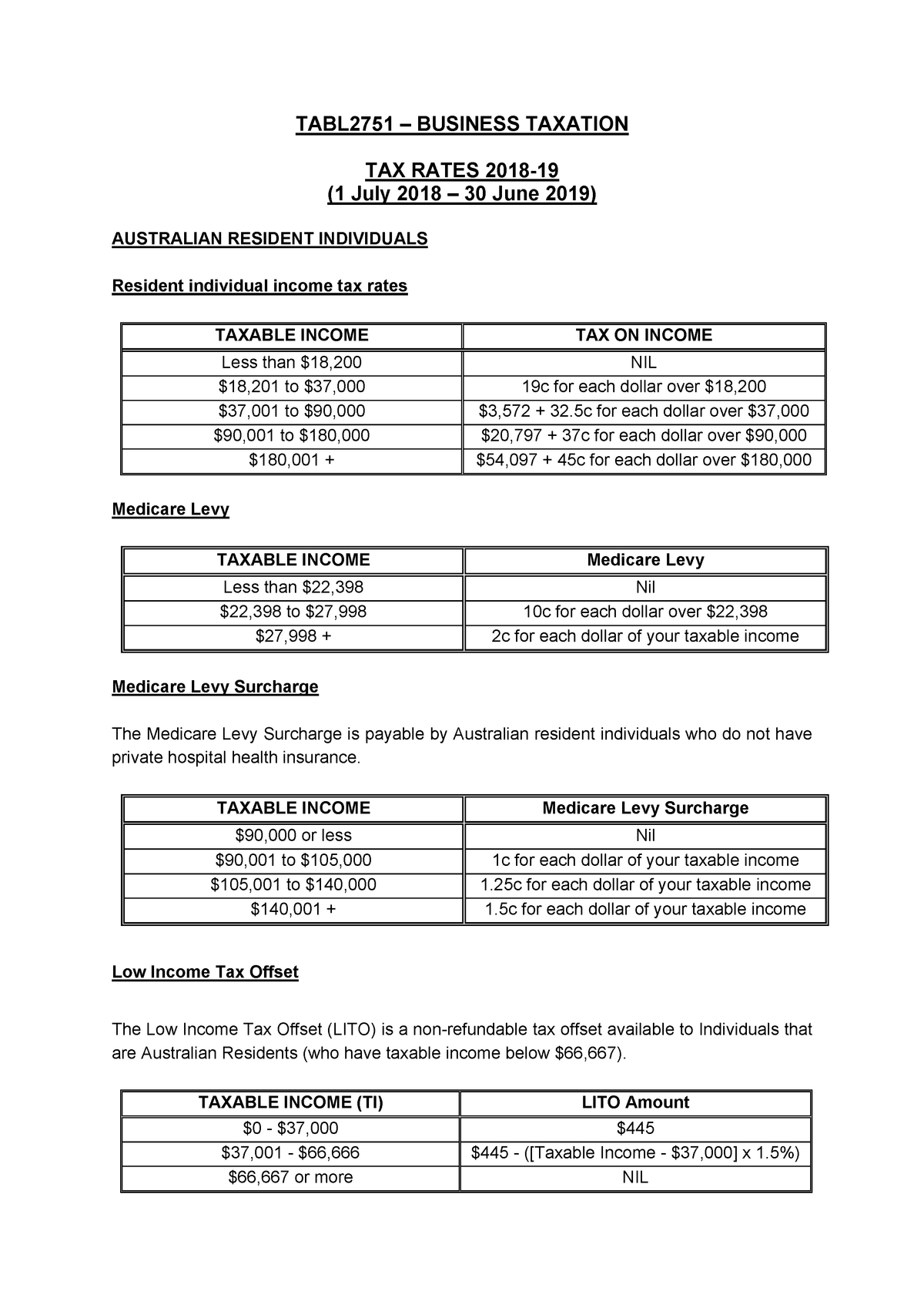

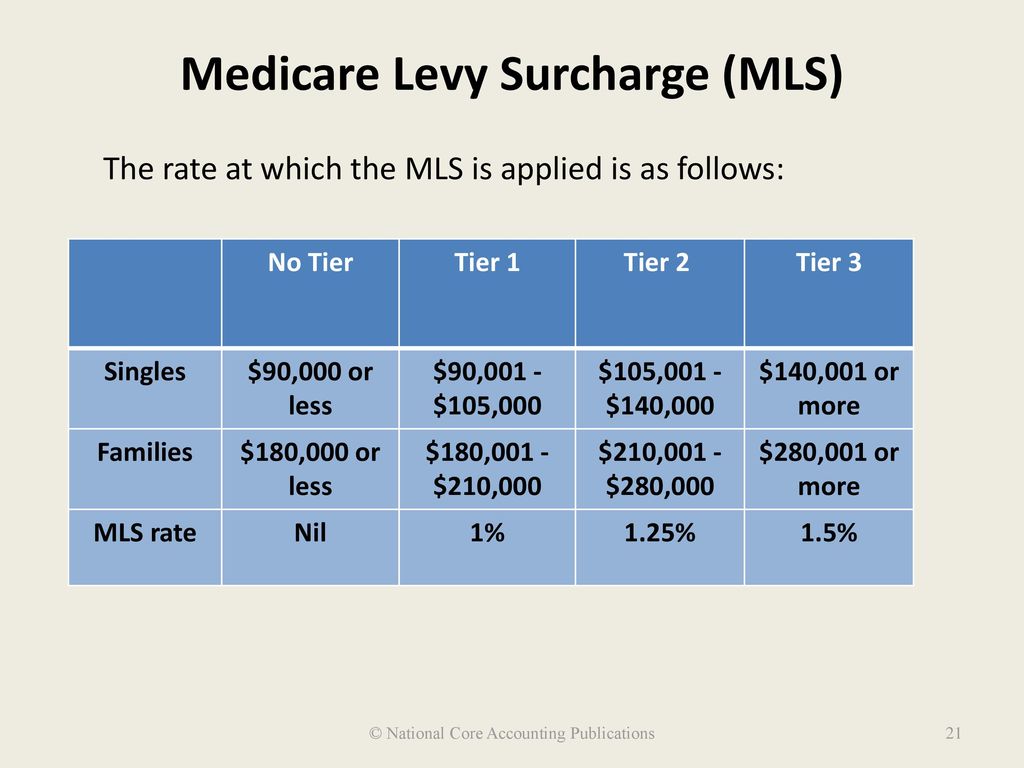

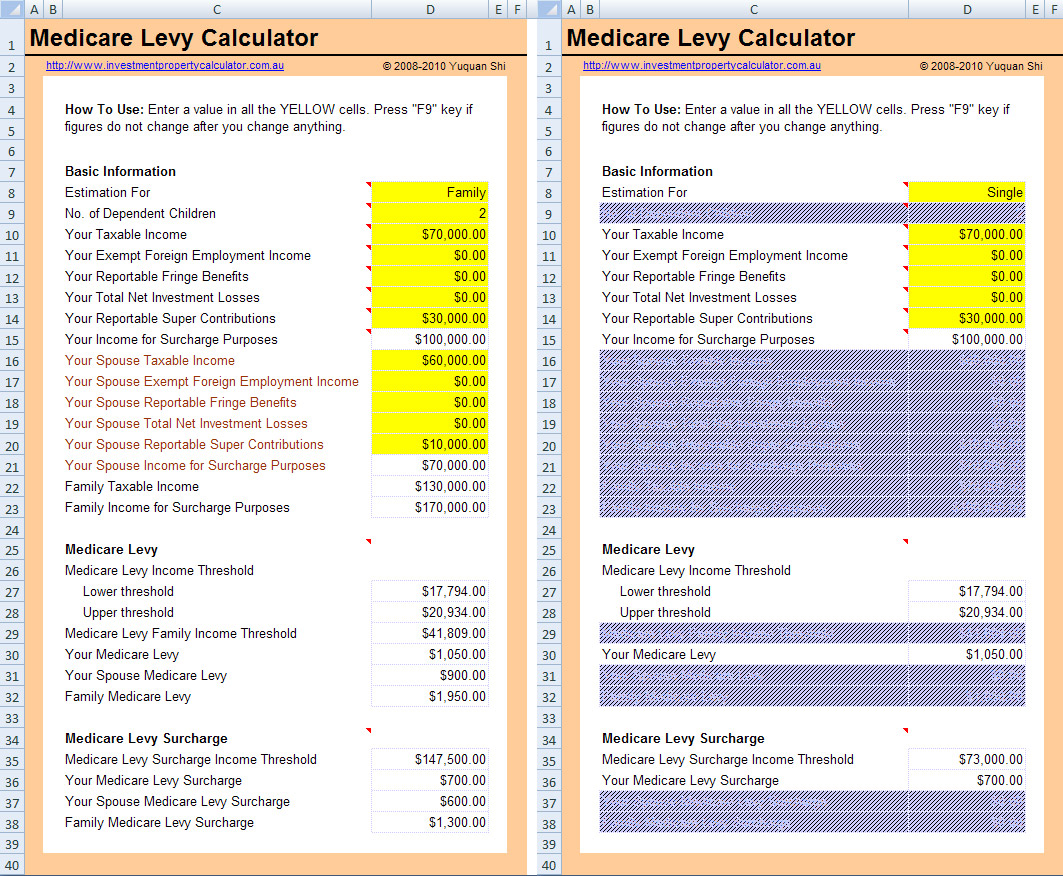

However revenue raised by the levy falls far short of funding the entirety of medicare expenditure and any shortfall is paid out of general government expenditure. In contrast the 1 15 medicare levy surcharge is only paid by people who earn over 90000 as an individual or over 180000 as a couple and dont have private health insurance. You may be liable for the medicare levy surcharge if you do not have an appropriate level of private patient hospital cover and earn above a certain income. Almost everyone pays tax pays the 2 medicare levy as part of their income taxes.

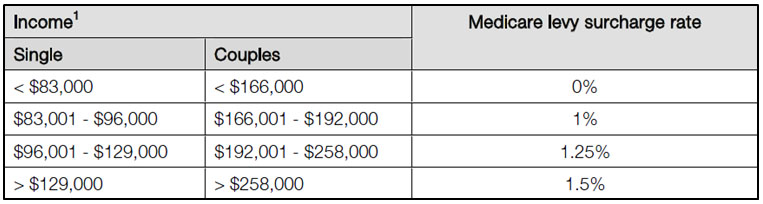

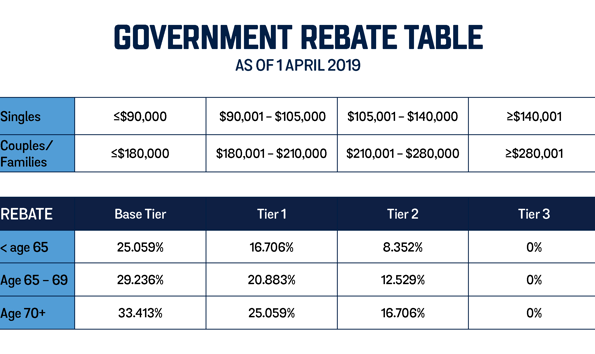

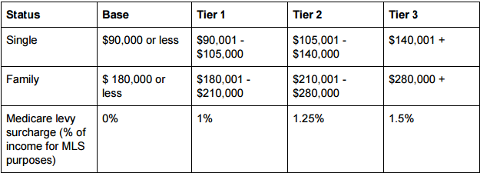

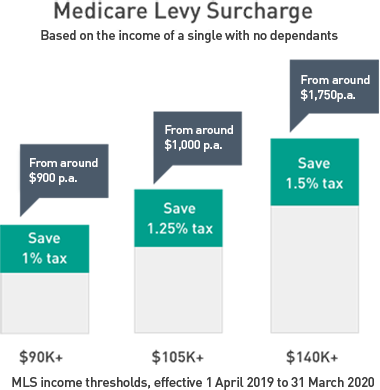

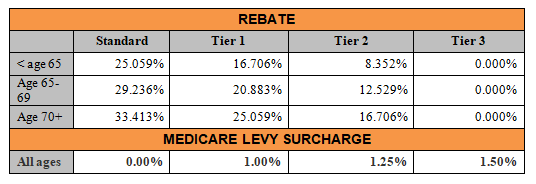

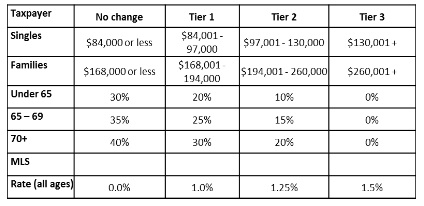

The percentage surcharge you pay depends on your income threshold as a single person or your combined income as a family which includes single parents and couples including de facto couples. Income thresholds and rates for the medicare levy surcharge. It is designed to encourage individuals to take out private hospital cover and where possible to use the private hospital system to reduce demand on the public medicare system. The medicare levy surcharge mls is a levy paid by australian tax payers who do not have private hospital cover and who earn above a certain income.

Subdivision 61l tax offset for medicare levy surcharge lump sum payments in arrears of the income tax assessment act 1997 might provide a tax offset for a person if medicare levy surcharge within the meaning of that act is payable by the person. The medicare levy surcharge mls is calculated at 1 to 15 of your income and usually needs to be paid in addition to the medicare levy of 2. The current income threshold is 90000 for singles and 180000 for couples and families including single parent families. This was done so as to encourage more people to take out private hospital cover if they are in an income bracket that should be able to afford it or if not to contribute more towards medicare than low income earners.