Rental Insurance Coverage

Free aaa renters insurance quotes.

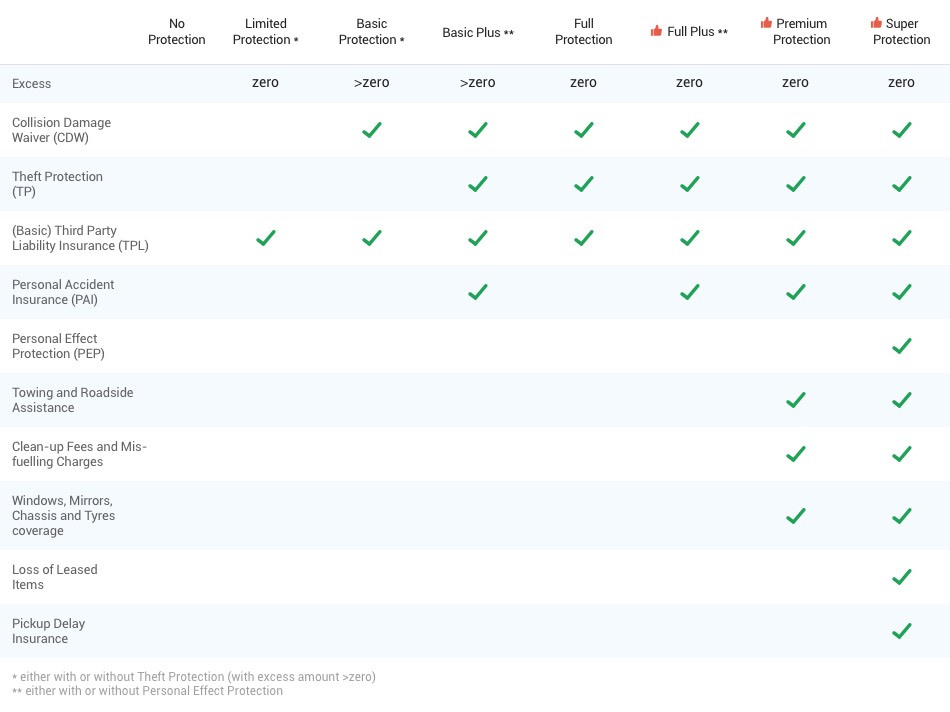

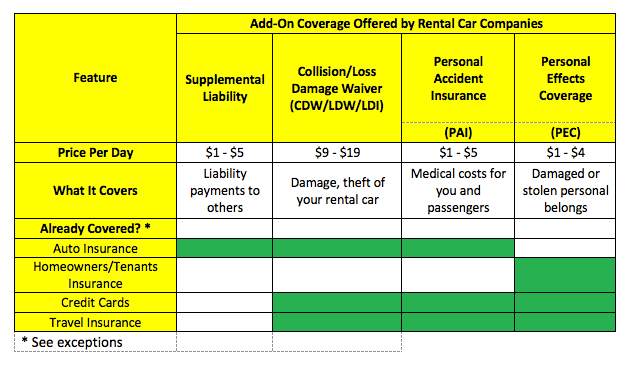

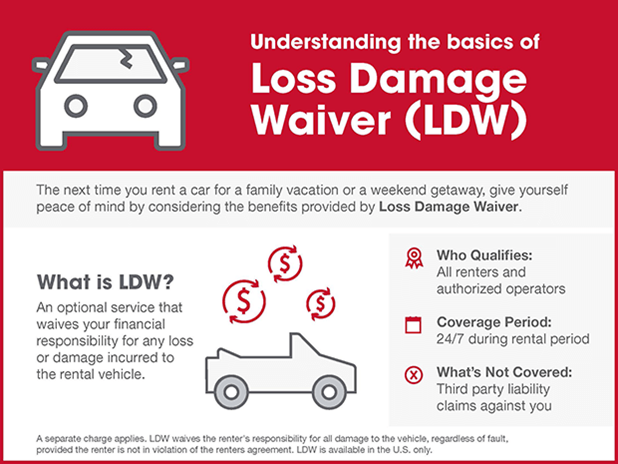

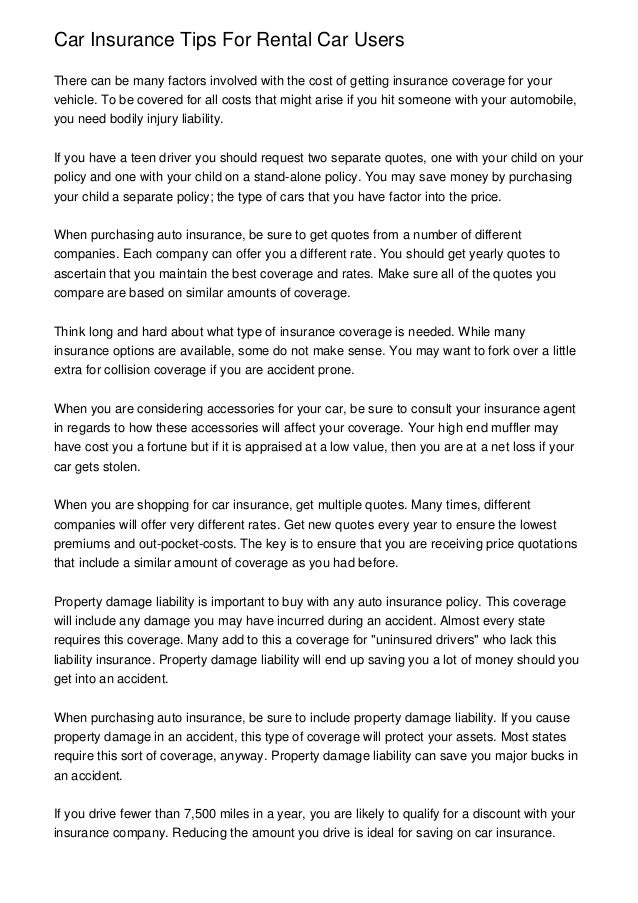

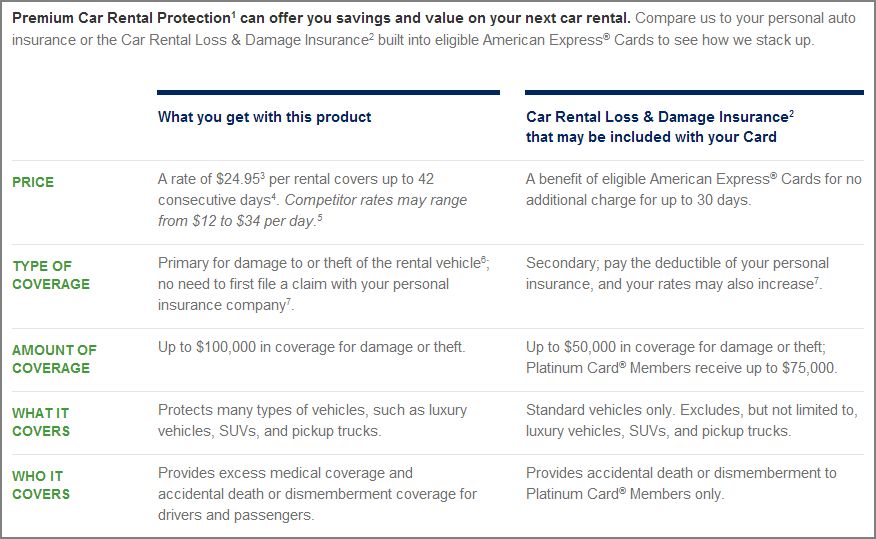

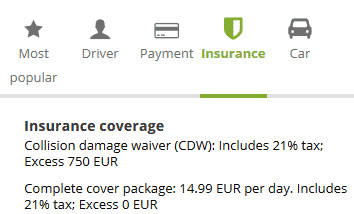

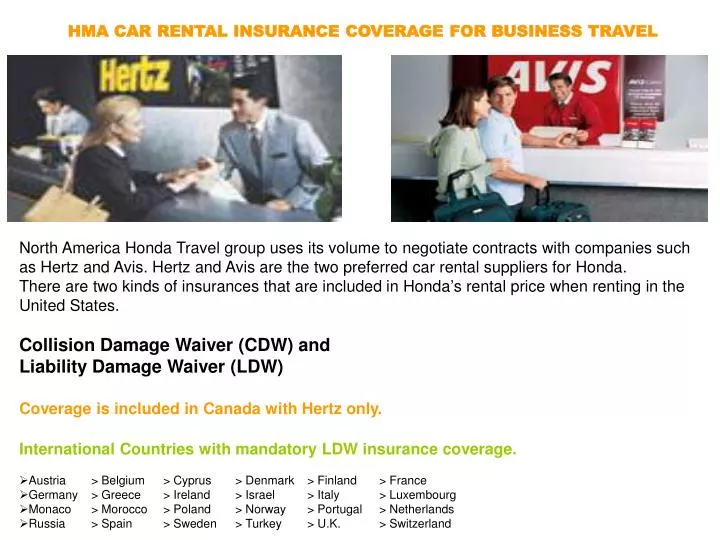

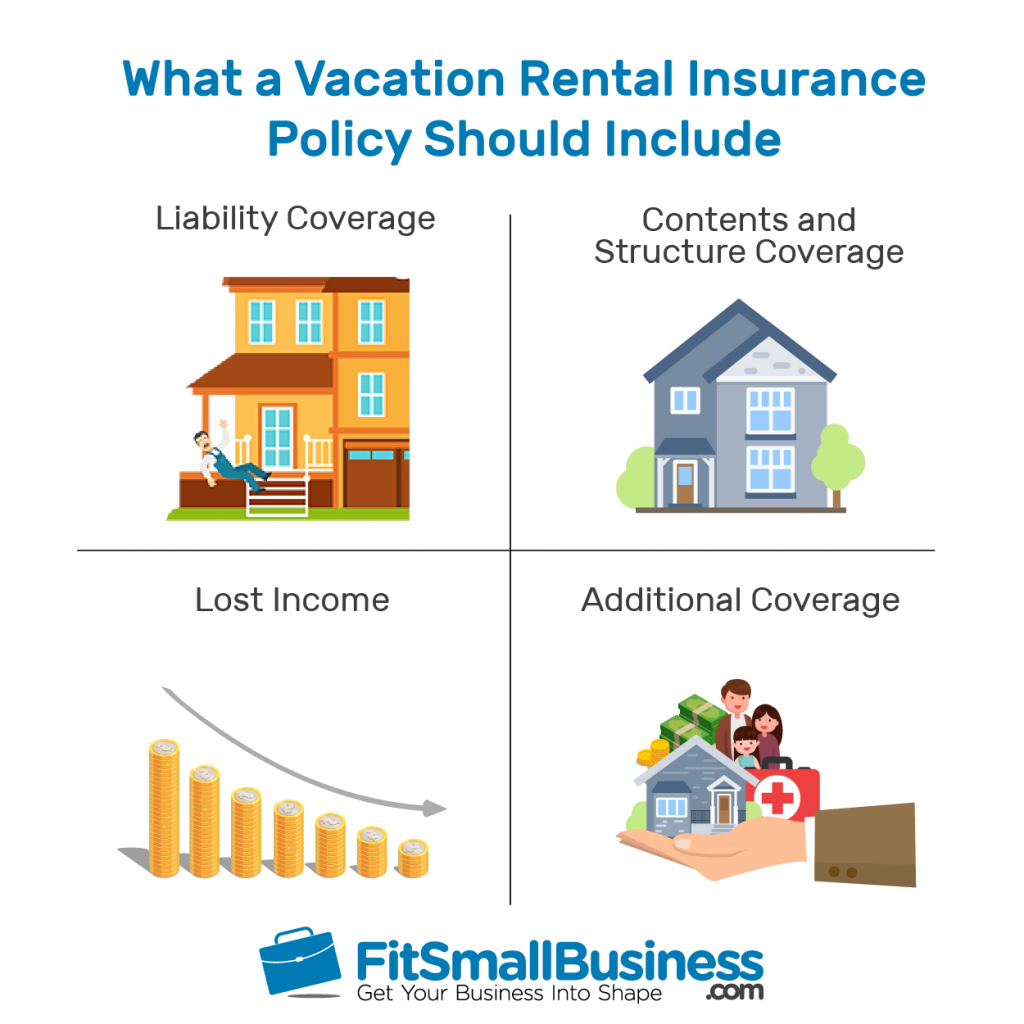

Rental insurance coverage. A renters insurance policy is a group of coverages designed to help protect renters living in a house or apartment. Most national insurance providers offer rental property insurance to help protect your rental income. Renters insurance is financial protection for a tenant and their personal belongings. Some rental car companies also offer supplemental liability insurance for a reasonable fee if you are unsure whether you have adequate coverage.

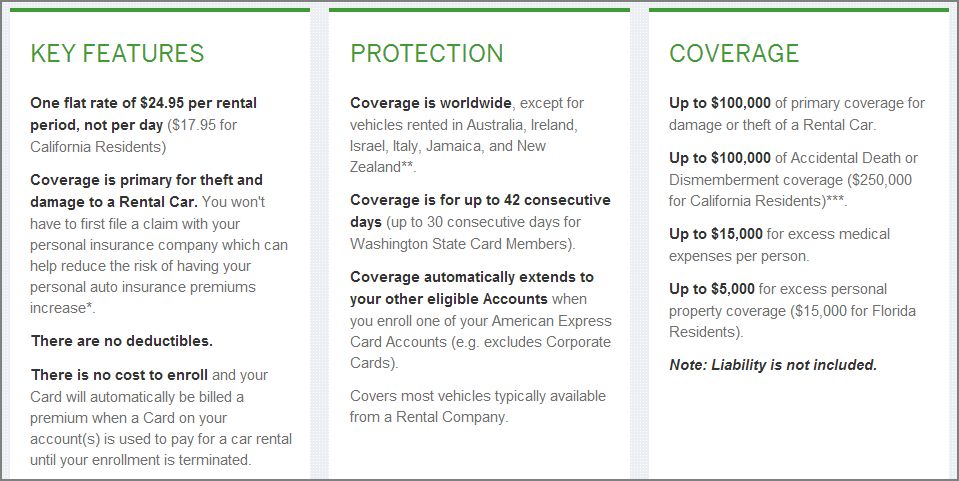

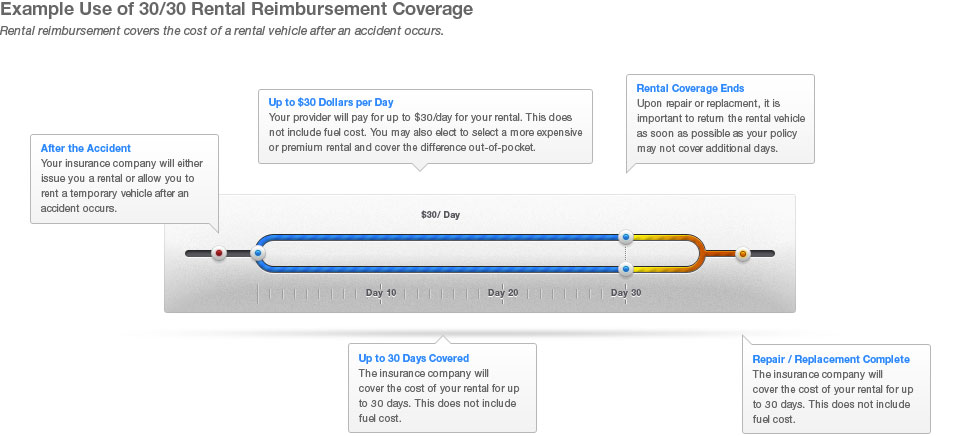

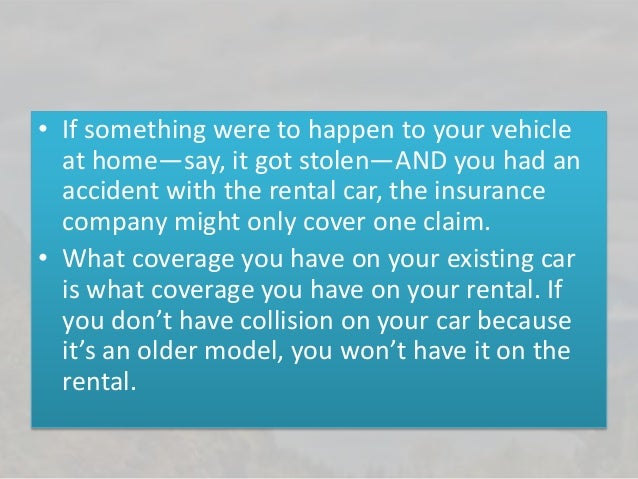

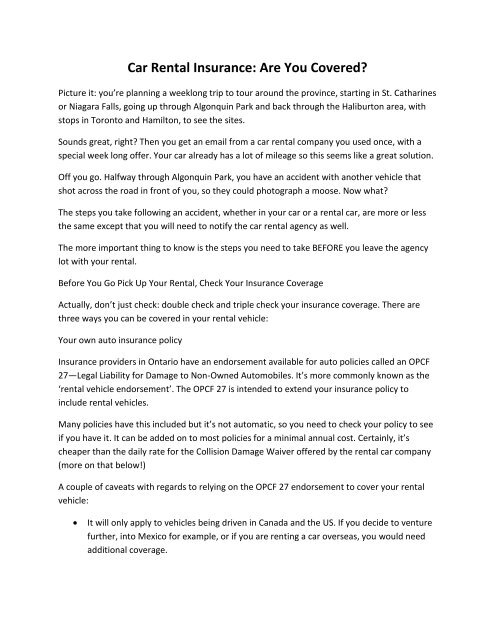

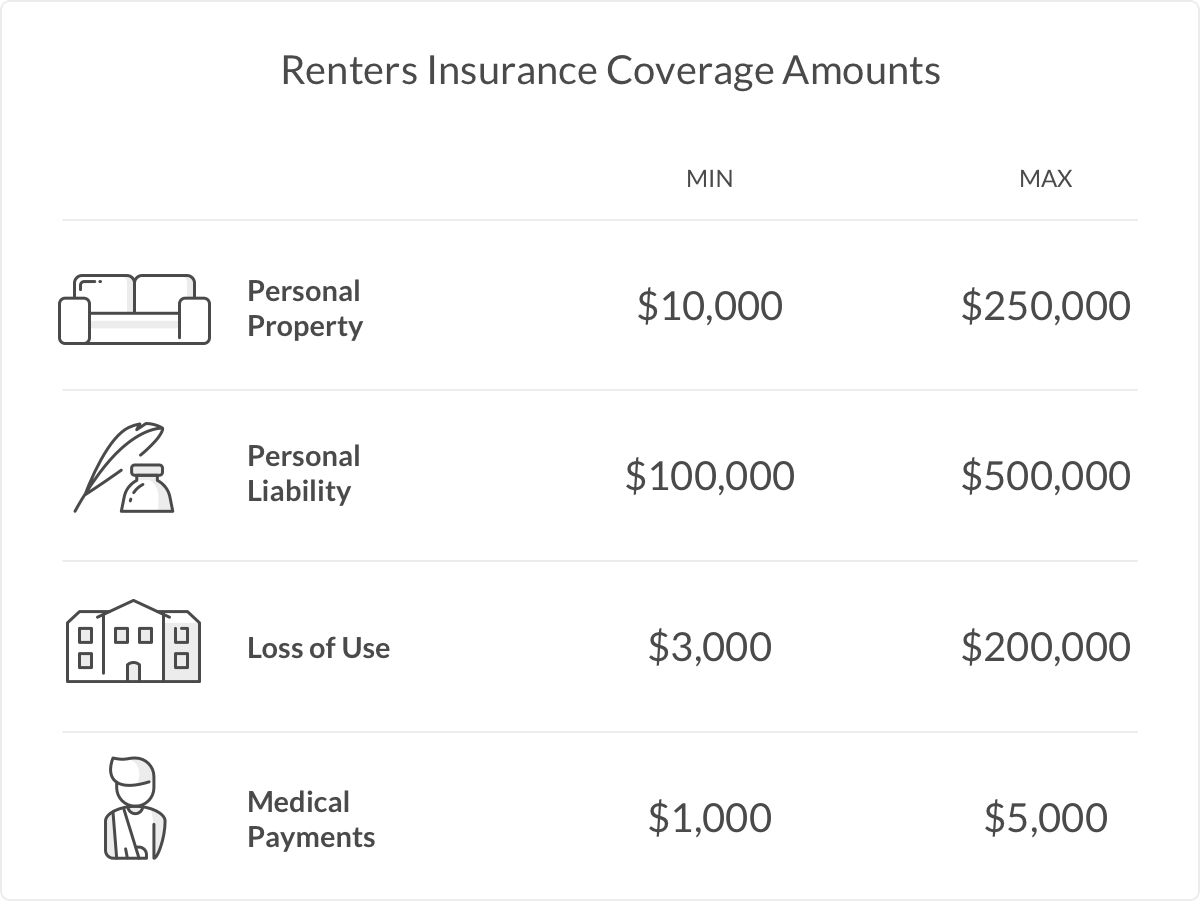

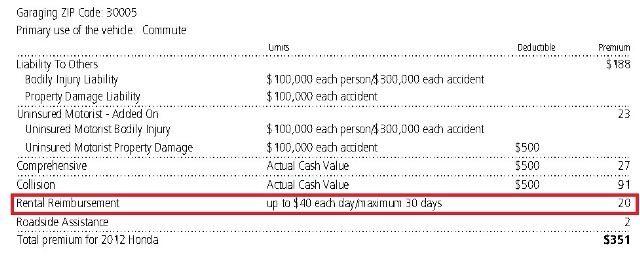

Our rental insurance also known as apartment insurance offers affordable premiums excellent coverage. There are three categories of coverage that make up a renters insurance policy. Note that rental car insurance is not the same as rental car reimbursement coverage an auto policy option that covers the cost of a car rental if your vehicle is being repaired as part of a claim. In addition to property coverage renters insurance will reimburse your legal and liability expenses if someone other than a family member is injured in your rental property.

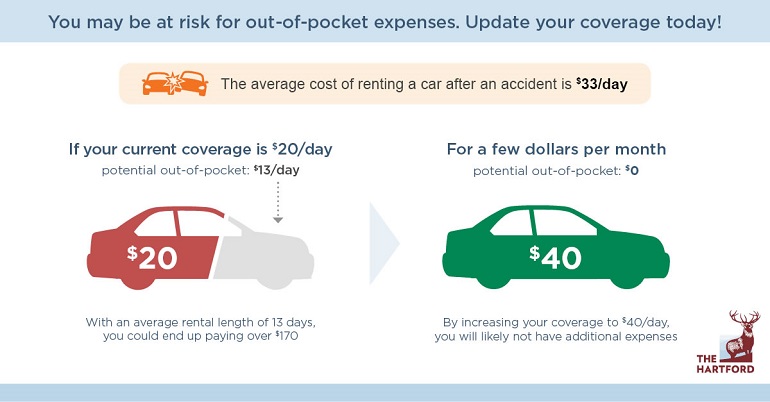

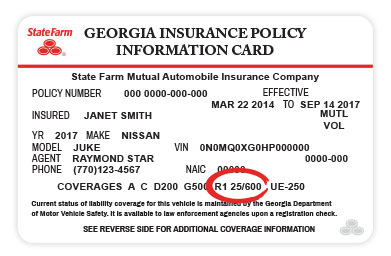

If your place is damaged due to a covered loss on your policy and you cant stay there loss of use coverage pays for hotelrent and food expenses above what youd usually pay. It is generally recommended that you increase your coverage to 1000000 or 2000000 because if you get in an accident and cause serious harm or death the minimum coverage will likely be inadequate. Personal property coverage personal liability coverage and loss of use coveragerenters insurance is a relatively cheap insurance product costing an average of 15 a month. Renters insurance can protect your personal property in cases of natural disaster weather issues unexpected damage theft vandalism and more.

Typically an average policy on a 200000 rental property costs 1473 to 1596 per year. And although its cheap renters insurance can offer. The truth about rental car insurance coverage adding the extra coverages can be a waste of money if your auto insurance policy already provides the coverage you need. Theres a fire at your apartment complex and youre forced to live elsewhere for two weeks while the landlord makes repairsrenters insurance will cover your hotel bill as well as restaurantfood costs over.