Renters Insurance Coverage

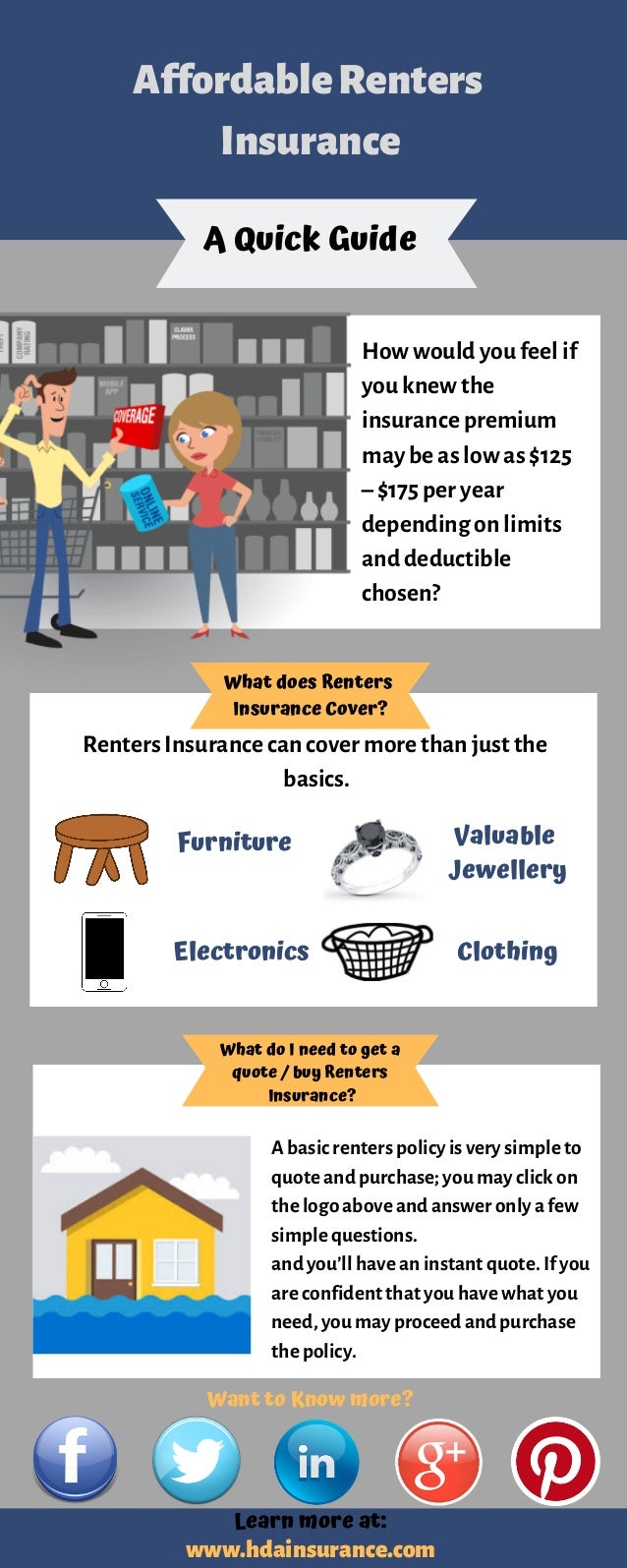

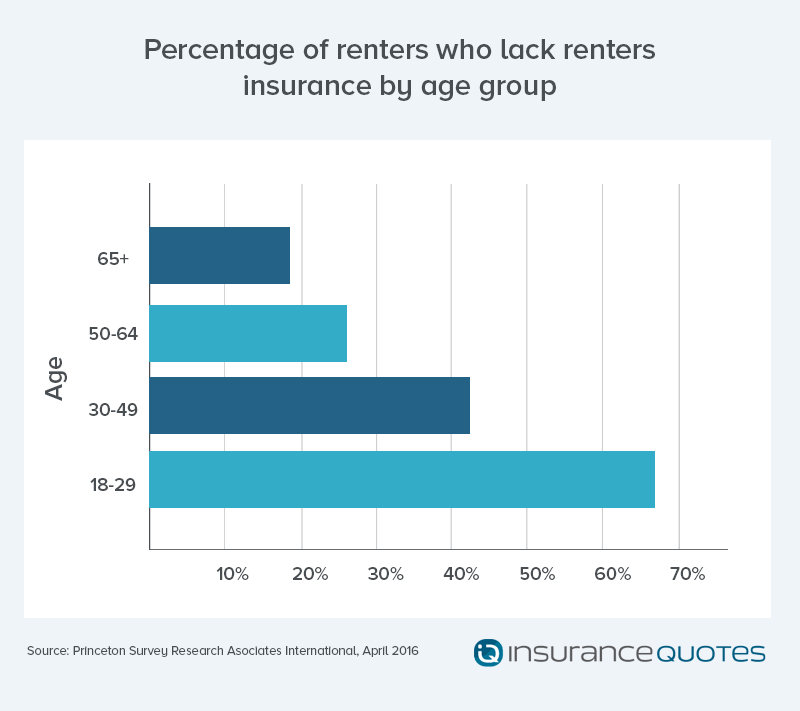

Personal property coverage personal liability coverage and loss of use coveragerenters insurance is a relatively cheap insurance product costing an average of 15 a month.

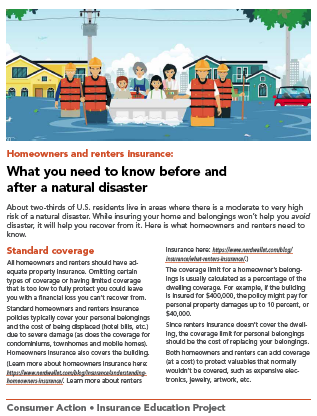

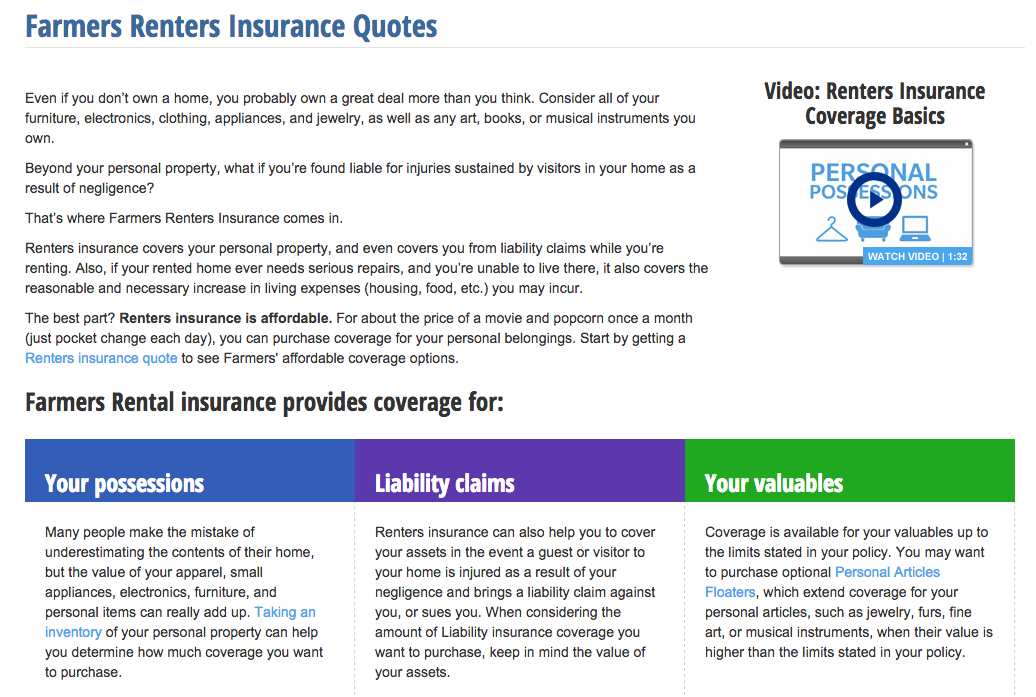

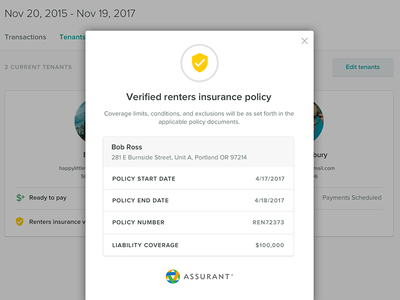

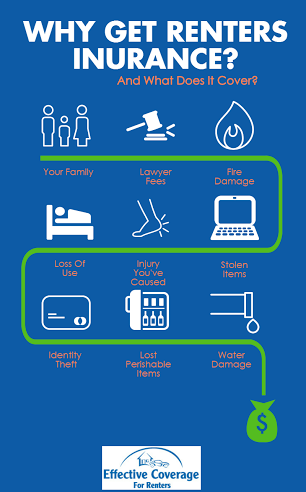

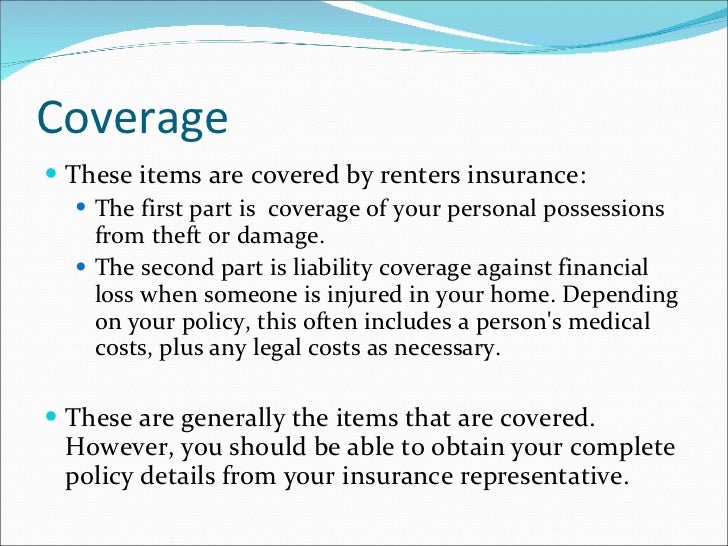

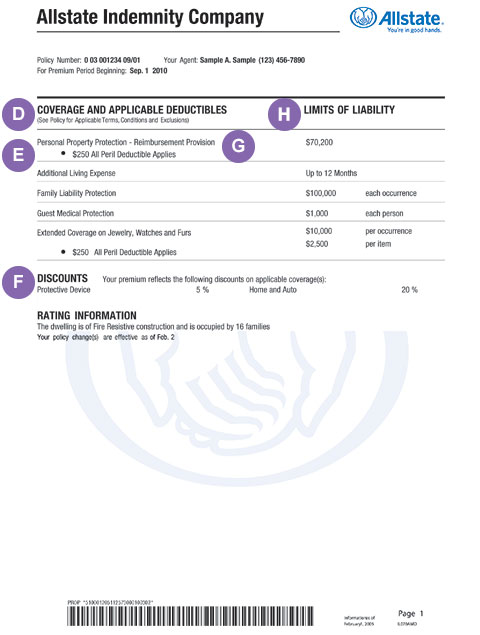

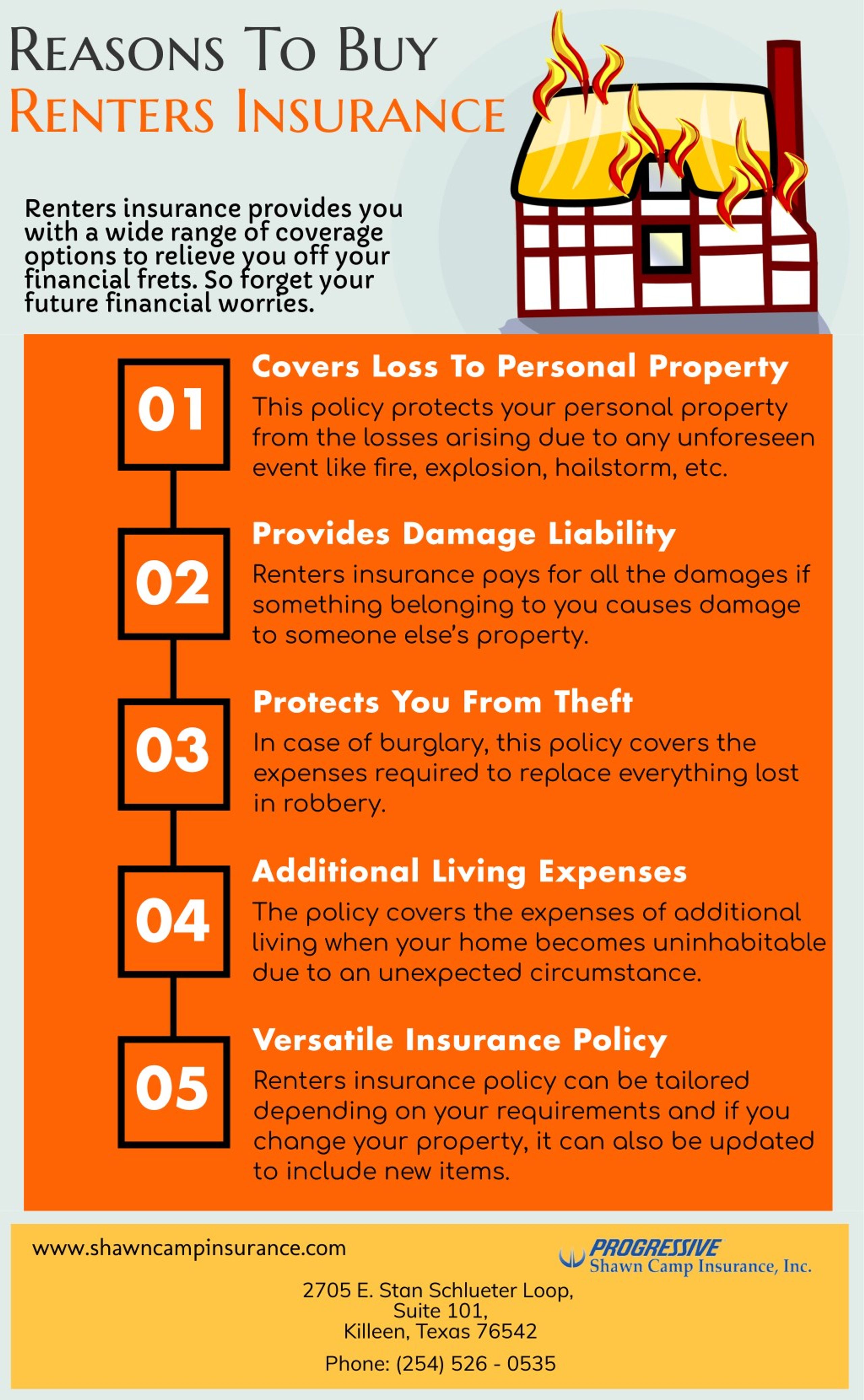

Renters insurance coverage. Free aaa renters insurance quotes. Amounts you choose such as 100000 of coverage for liability claims and legal defense. Renters insurance coverage is designed for those who rent an apartment a condo or a home to cover belongings in the case of accidental damage or covered losses such as fire or theft. If your place is damaged due to a covered loss on your policy and you cant stay there loss of use coverage pays for hotelrent and food expenses above what youd usually pay.

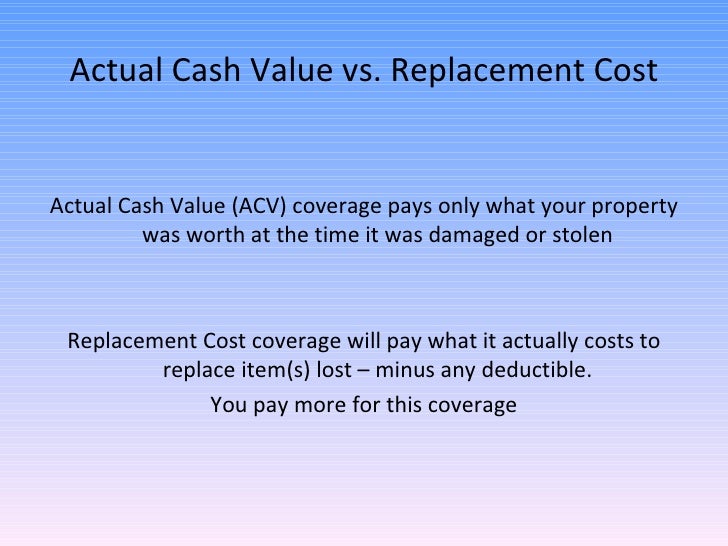

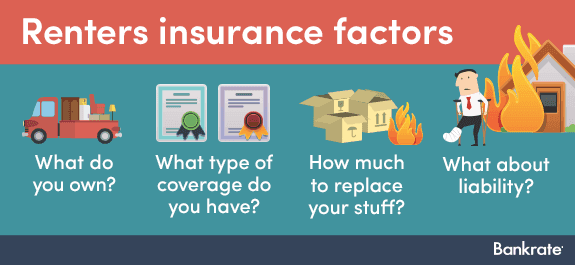

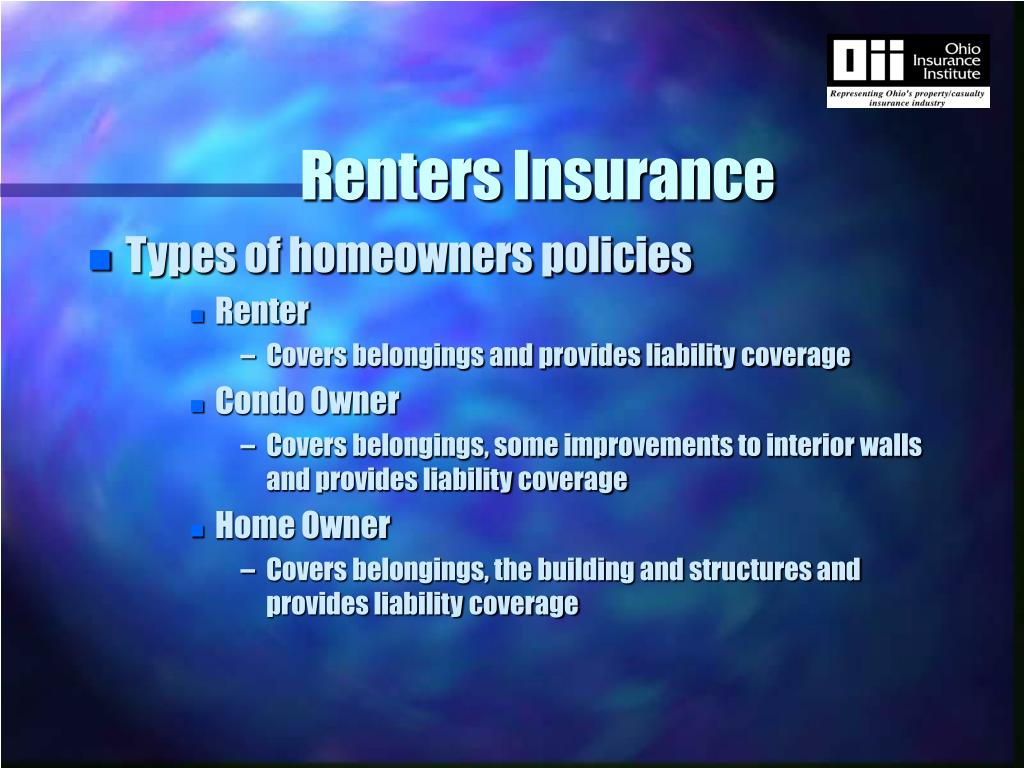

Renters insurance is financial protection for a tenant and their personal belongings. And although its cheap renters insurance can offer. When you choose a renters insurance policy you will need to choose coverage amounts for three basic types of coverage. What does renters insurance cover.

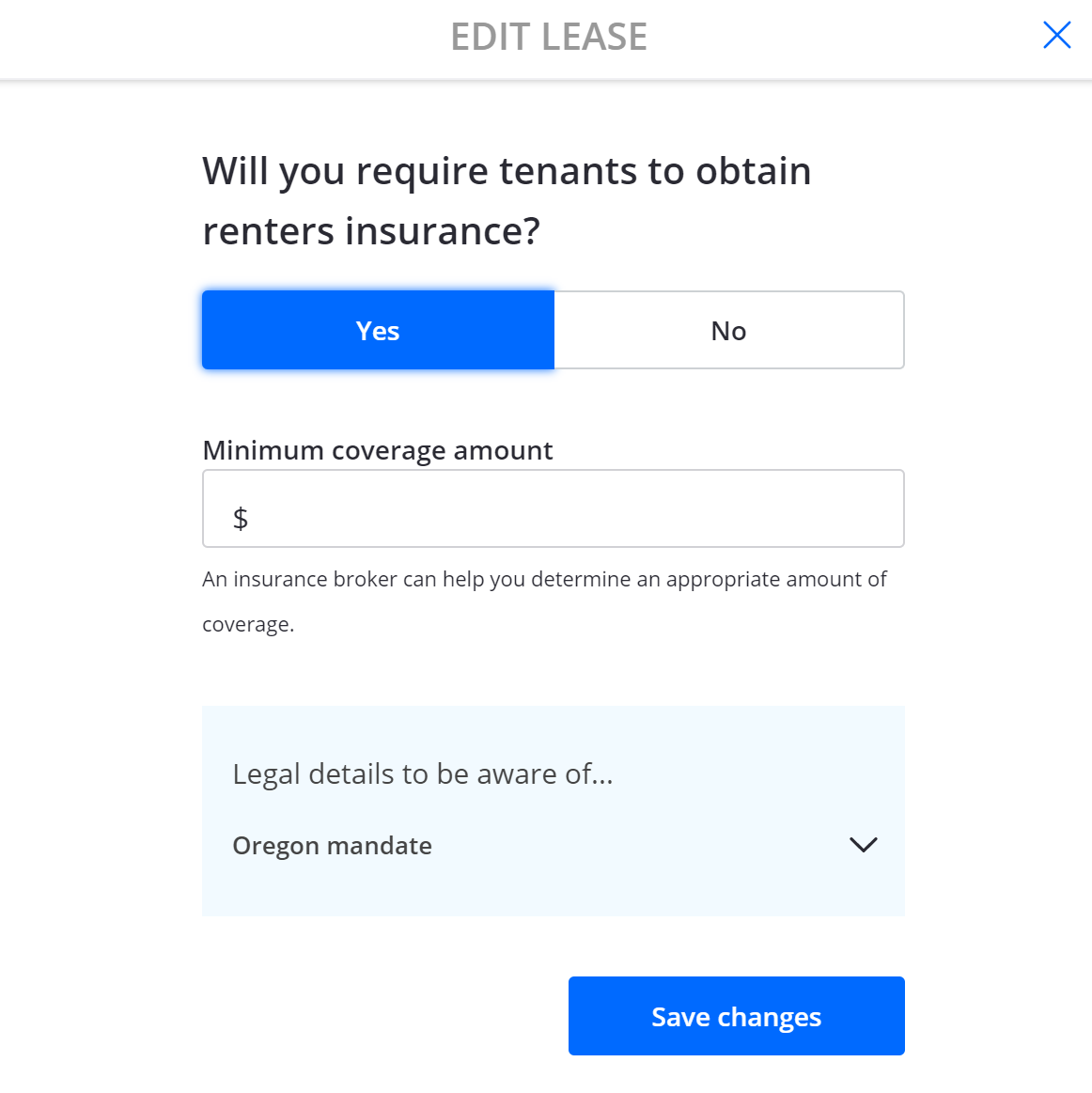

So why is coverage a on my renters insurance policy. There are three categories of coverage that make up a renters insurance policy. Typically a minimum of 2500 worth of coverage liability. Eventually additional types of insurance were added and it developed into a homeowners policy.

Our rental insurance also known as apartment insurance offers affordable premiums excellent coverage. A typical renters insurance policy includes three types of coverage that help protect you your belongings and your living arrangements after a covered loss. Get a renters quote. Renters insurance can protect your personal property in cases of natural disaster weather issues unexpected damage theft vandalism and more.

Theres a fire at your apartment complex and youre forced to live elsewhere for two weeks while the landlord makes repairsrenters insurance will cover your hotel bill as well as restaurantfood costs over. Originally there was fire insurance which covered just that fire. It also runs the gamut of medical payments property damage to others and temporary living expenses to name but a few. A renters insurance policy does not provide coverage for your belongings if theyre damaged under certain events.

Renters insurance coverage a is there because of the way the policy form was created. Renters insurance coverage protects more than your belongings at and away from home. If you rent an apartment home or even a dorm renters insurance is recommended for protecting your space and belongings in the event of a covered accident. Plus it could help you save on auto insurance.