Term Insurance Policy

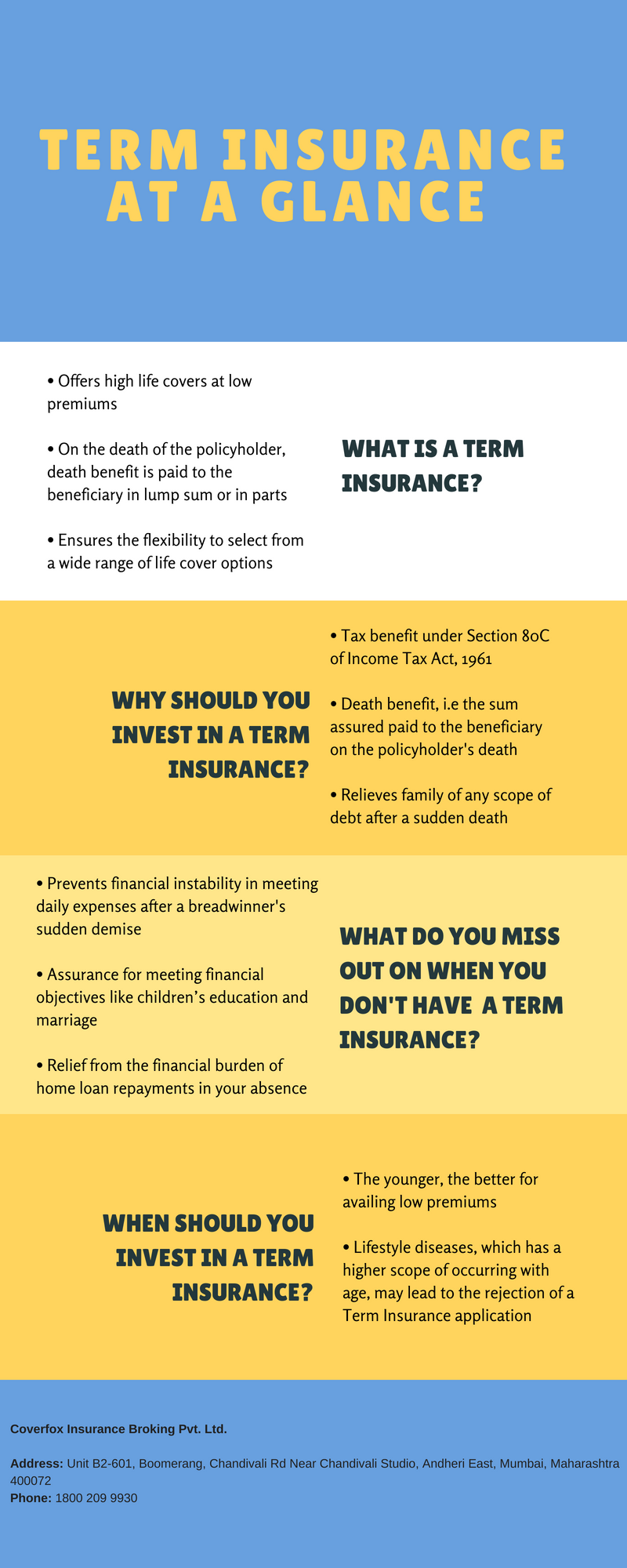

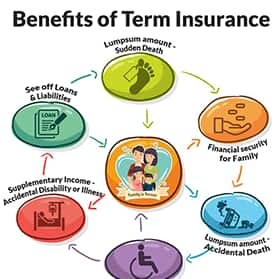

Term insurance also known as pure life insurance is a plan which provides coverage for a specified period of time and guarantees payment of a specified benefit on death.

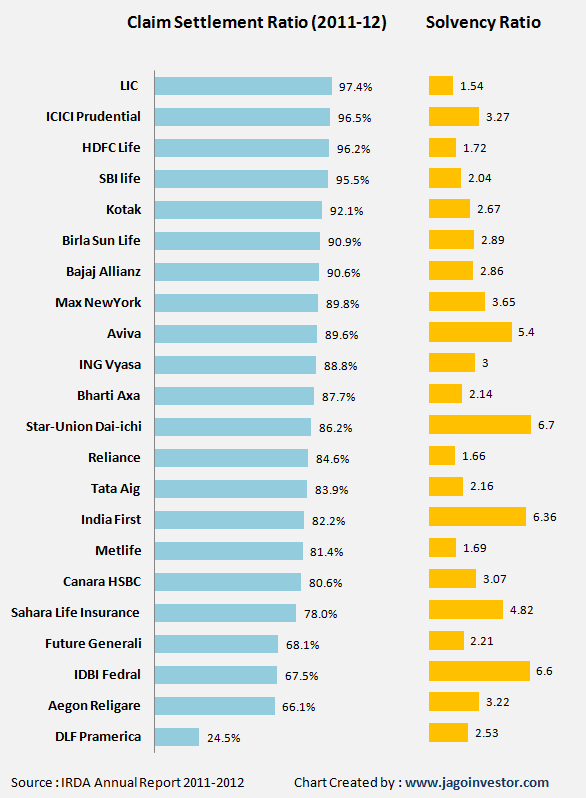

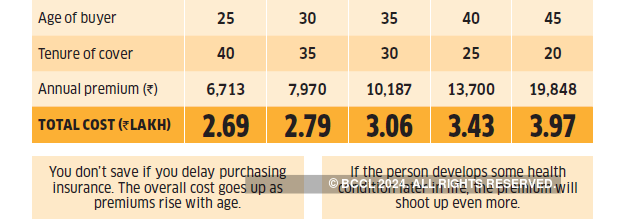

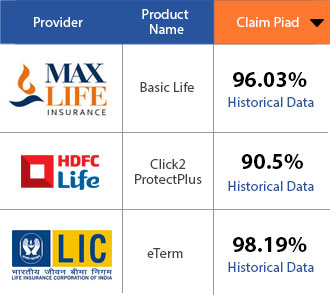

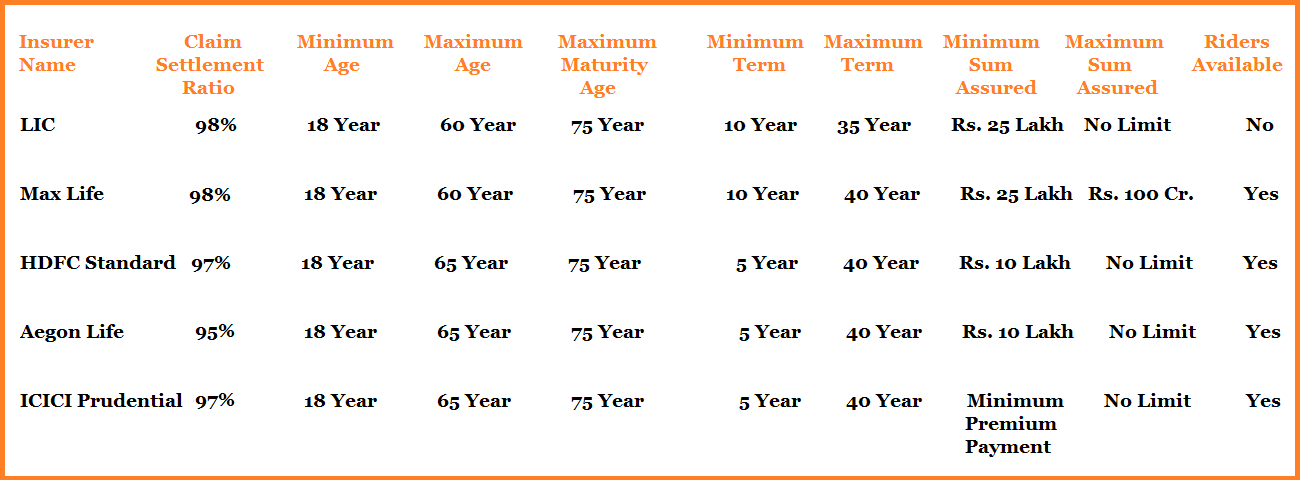

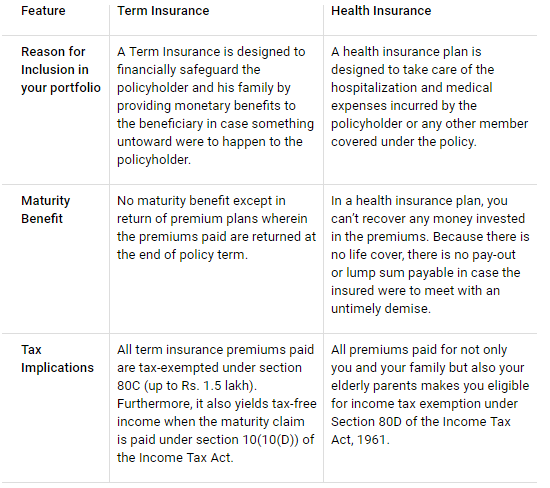

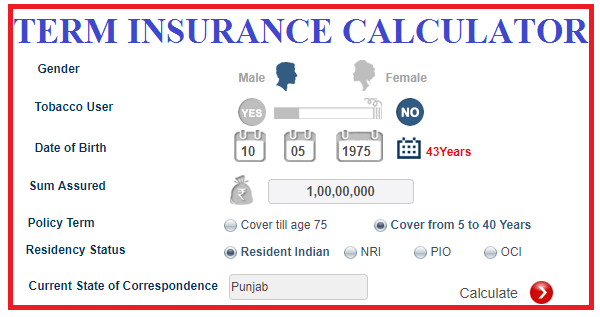

Term insurance policy. Before buying term insurance policy ensure that the insurance company you wish to opt for is reliable and stable enough to develop trust among their customers. Term life insurance can be contrasted to permanent life insurance such as whole life universal life and variable universal life which guarantee coverage at fixed premiums for the lifetime of the covered individual unless the policy is allowed to lapse. Term insurance is the most affordable form of insurance that provides high life cover for a specific period of time. A term insurance plan provides life insurance cover against the fixed premium paid for specified term of the year.

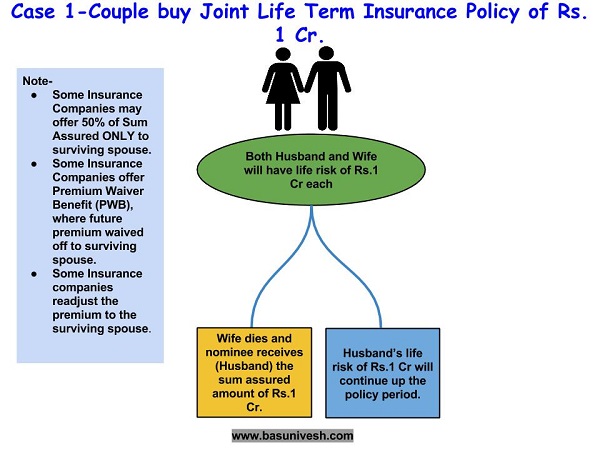

John hancock offers a full range of life insurance products including simplified issue meaning you only have to complete a medical questionnaire and fully underwritten term policies which involve a medical exampolicies are available for 10 15 20 and 30 year terms and many can be convertible into permanent policies. The nominee of the insured person receives the death benefit if the insured dies when the policy is active. What is term insurance policy. Term insurance companys reliability.

Basis the companys reputation and the financial goodwill you will get a clear picture of its business and the bankruptcy status. In the event of demise of the insured during the policy period the death benefit is payable to the nominee or beneficiary. Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years. If you decide to convert your policy john hancock offers a wide.

In case of the insureds demise during the term of the policy a lump sum amount is paid out to the beneficiary as death benefit provided the policy is in force. Term insurance is not generally used for estate planning needs or charitable giving. In insurance the insurance policy is a contract generally a standard form contract between the insurer and the insured known as the policyholder which determines the claims which the insurer is legally required to pay. In exchange for an initial payment known as the premium the insurer promises to pay for loss caused by perils covered under the policy language.

Term insurance is basically a type of life insurance that provides coverage for a certain period of time or years. You can avail a term insurance policy by paying low premium and secure the financial needs of your family in your absence.